Loading

Get Ct Drs Drs-pw 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT DRS DRS-PW online

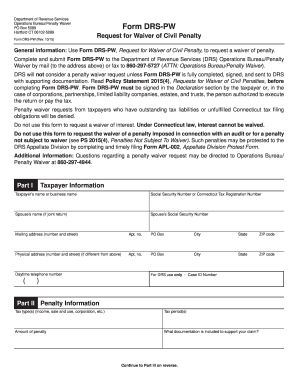

The CT DRS DRS-PW form is designed for individuals and entities seeking a waiver of civil penalties from the Department of Revenue Services. This guide will provide you with clear instructions on how to complete the form online, ensuring a smooth submission process.

Follow the steps to successfully complete and submit the form.

- Click the ‘Get Form’ button to access the DRS-PW form digitally.

- In Part I, input your taxpayer information, including your name or business name, Social Security Number or Connecticut Tax Registration Number, and your mailing address. If this is a joint return, include your partner's information as well.

- Continue to Part II to provide the relevant penalty information. Indicate the tax type, the tax period, and the amount of the penalty you are requesting a waiver for. Additionally, specify what documentation you are including to support your claim.

- Move on to Part III, where you will describe the facts and circumstances that led to your inability to comply with tax obligations. Provide detailed explanations for each sub-question, and attach any relevant supporting documentation to strengthen your request.

- In the Declaration section, ensure you carefully read and acknowledge the statements regarding your compliance with tax obligations. Sign and date the form. If applicable, include your title if you are submitting on behalf of a business entity.

- After completing all sections, double-check your entries for accuracy, then save your changes, download the form, and print a copy if needed. Finally, you may choose to share the form electronically or prepare it for mailing.

Complete your CT DRS DRS-PW form online today and ensure timely submission for your penalty waiver request.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

In accounting, DRS typically refers to the Department of Revenue Services, which oversees taxation. Understanding this can help you navigate tax preparation and compliance more effectively. It’s crucial to work in tandem with the guidelines provided by the CT DRS DRS-PW to keep your financial records precise and up to date.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.