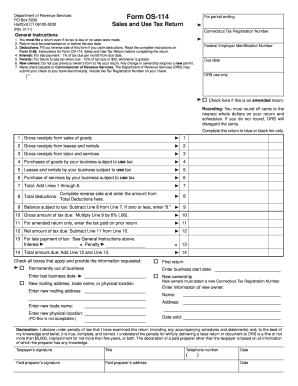

Get Ct Drs Os-114 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign CT DRS OS-114 online

How to fill out and sign CT DRS OS-114 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

If the tax period started unexpectedly or perhaps you simply overlooked it, it might lead to issues for you. CT DRS OS-114 isn’t the most straightforward form, but you shouldn’t stress in any situation.

Using our user-friendly solution, you will discover how to complete CT DRS OS-114 in times of urgent time shortage. You just need to adhere to these basic guidelines:

With this comprehensive digital solution and its useful tools, filling out CT DRS OS-114 becomes easier. Don’t hesitate to try it out and spend more time on hobbies rather than on preparing documents.

Access the document in our sophisticated PDF editor.

Input all the necessary information in CT DRS OS-114, using the fillable fields.

Insert images, marks, checks, and text boxes, if required.

Repeating fields will be automatically included after your initial entry.

If you encounter any confusion, utilize the Wizard Tool. It will provide you with guidance for easier submission.

Do not forget to add the date of submission.

Create your unique signature once and position it in all the necessary areas.

Verify the information you have entered. Amend errors if necessary.

Click on Done to complete modifications and select your preferred method of submission. You can use digital fax, USPS, or email.

You may also download the document to print later or upload it to cloud storage such as Google Drive, OneDrive, etc.

How to Adjust Get CT DRS OS-114 2011: Tailor Forms Online

Completing documents is more convenient with intelligent online tools. Remove paperwork with easily accessible Get CT DRS OS-114 2011 templates that you can customize online and print.

Preparing documents and forms should be more attainable, whether it’s a routine aspect of one’s job or occasional tasks. When someone needs to submit a Get CT DRS OS-114 2011, understanding regulations and instructions on how to properly fill out a form and what it should contain can be time-consuming and demanding. However, if you locate the right Get CT DRS OS-114 2011 template, completing a document will no longer be a hassle with an intelligent editor available.

Explore a wider array of functionalities you can include in your document workflow. No need to print, complete, and mark forms by hand. With a smart editing platform, all vital document processing capabilities are readily available. If you want to enhance your work process with Get CT DRS OS-114 2011 forms, find the template in the repository, click on it, and uncover an easier method to fill it out.

Familiarizing yourself with more tools makes working with Get CT DRS OS-114 2011 simpler. Try the solution that provides everything needed to find and modify forms within a single browser tab and forget about traditional paperwork.

- To insert text in any area of the form or to add a text field, utilize the Text and Text Field tools and expand the text as much as needed.

- Use the Highlight tool to emphasize the crucial sections of the form.

- If you wish to hide or eliminate certain text portions, apply the Blackout or Erase tools.

- Personalize the form by incorporating default graphic elements. Use the Circle, Check, and Cross tools to add these features to the forms if required.

- If you need extra notes, employ the Sticky Note tool and position as many notes on the forms page as necessary.

- Should the form need your initials or date, the editor provides tools for that as well. Minimize the chance of mistakes by using the Initials and Date tools.

- Custom visual elements can also be added to the form. Use the Arrow, Line, and Draw tools to modify the file.

When paying your Connecticut state tax by check, make it payable to the 'Connecticut Department of Revenue Services.' Ensure you include your tax ID and any relevant tax year information on the check to avoid processing delays. If you're unsure about your payment method, the CT DRS OS-114 can provide the necessary details.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.