Get Il St-589 2015-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL ST-589 online

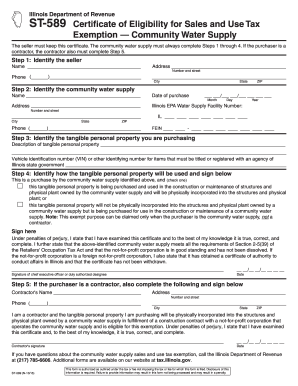

Filling out the IL ST-589, Certificate of Eligibility for Sales and Use Tax Exemption, is a crucial step for community water supplies and contractors seeking tax exemptions. This guide provides detailed instructions for completing the form accurately and efficiently online.

Follow the steps to complete the IL ST-589 form online.

- Press the ‘Get Form’ button to access the IL ST-589 form and open it in the editor.

- In Step 1, identify the seller by entering their name, address, and phone number in the designated fields.

- For Step 2, provide the community water supply's name, address, and date of purchase. Additionally, enter the Illinois EPA water supply facility number and the FEIN accurately.

- In Step 3, describe the tangible personal property being purchased. If it requires titling or registration, include the Vehicle Identification Number (VIN) or another identifying number.

- Step 4 involves indicating how the tangible personal property will be used. Choose the appropriate option and ensure that the chief executive officer or an authorized designee signs and dates the form.

- If the purchaser is a contractor, complete Step 5 by entering the contractor's name, address, and phone number. The contractor must also sign and date this section.

- Finally, review all the information provided for accuracy. Once verified, users can save changes, download, print, or share the form as needed.

Start completing your IL ST-589 online now to ensure compliance and secure your tax exemption.

The amount you should withhold for Illinois taxes largely depends on your income level, filing status, and the number of allowances you claim. The Illinois withholding tables provide specific guidance on determining the appropriate amount. It is advisable to review your withholdings regularly to ensure they match your changing financial situation. For comprehensive support, consider resources like the IL ST-589.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.