Get Ca Ftb 8453-c 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 8453-C online

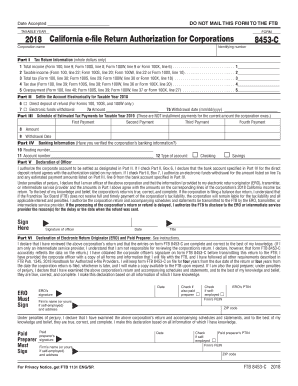

The CA FTB 8453-C is the California e-file return authorization for corporations. Completing this form accurately is crucial for ensuring your corporate tax return is processed smoothly and efficiently. This guide provides step-by-step instructions on how to fill out the form online, making the process simple and straightforward for you.

Follow the steps to complete the CA FTB 8453-C online seamlessly.

- Click ‘Get Form’ button to obtain the form and open it in your digital document editor.

- Enter the taxable year in the corresponding section to indicate the period for which you are filing. For example, for the 2018 tax year, write '2018'.

- In Part I, fill in the total income fields based on the required forms — specifically line 9 of Form 100, line 8 of Form 100S, line 9 of Form 100W, or line 6 of Form 100X.

- Provide the taxable income by referencing the appropriate lines: line 22 of Form 100, line 20 of Form 100S, line 22 of Form 100W, or line 10 of Form 100X.

- Complete the total tax amount by inputting the figures from line 30 of Form 100, line 29 of Form 100S, line 30 of Form 100W, or line 18 of Form 100X.

- Enter the tax due amount based on line 39 of Form 100, line 38 of Form 100S, line 36 of Form 100W, or line 20 of Form 100X.

- Indicate any overpayment by citing line 40 of Form 100, line 39 of Form 100S, line 37 of Form 100W, or line 27 of Form 100X.

- In Part II, specify if you wish to receive a direct deposit refund by checking the appropriate box, if applicable.

- If opting for electronic funds withdrawal, complete lines 7a and 7b, detailing the withdrawal amount and date.

- Move to Part III and record the estimated tax payments for the following year. Fill in the amount and withdrawal dates for each payment.

- In Part IV, provide banking information, including the routing number and account number. Confirm the account type (checking or savings).

- In Part V, the officer of the corporation must provide their signature and date to authorize the form.

- If applicable, ensure that the Electronic Return Originator or paid preparer signs and dates the form in Part VI.

- Once all sections are filled in, review your information for accuracy. Save changes, and consider downloading or printing a copy for your records.

Complete your CA FTB 8453-C form online today for a hassle-free filing experience!

Get form

The purpose of the 8453 form is to authorize the electronic submission of your tax return while maintaining the integrity of taxpayer information. This form ensures that you're compliant with California tax laws and provides the CA FTB with necessary details. By leveraging the efficiency of the 8453 form, you streamline your filing process. This results in quicker refunds and reduces the likelihood of errors.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.