Loading

Get De 5401(8)co 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DE 5401(8)CO online

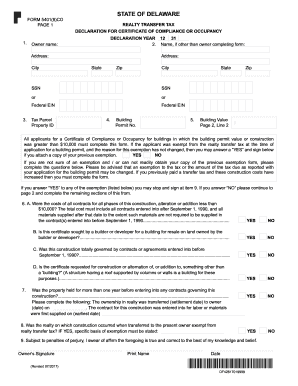

This guide provides clear and supportive instructions for completing the DE 5401(8)CO form online. It aims to help users navigate the form efficiently, ensuring accurate submission for obtaining a certificate of compliance or occupancy.

Follow the steps to complete the DE 5401(8)CO online.

- Press the ‘Get Form’ button to access the DE 5401(8)CO form and open it for editing.

- Enter the owner's name in the designated field, along with their address, city, state, and ZIP code.

- Provide the Social Security Number (SSN) or Federal Employer Identification Number (EIN) as needed.

- Fill in the tax parcel number or property ID requested on the form.

- Indicate the building permit number and the estimated building value.

- Answer the exemption questions provided; if applicable, attach a copy of previous exemptions.

- Respond to the construction cost question by indicating if all contracts are under $10,000.

- If applicable, confirm whether the certificate is for a builder’s resale and if prior contracts were established before a certain date.

- Complete questions regarding the ownership and any exemptions related to realty transfer tax.

- Sign at the designated section to affirm the correctness of the information provided.

- Finally, save your changes, and you can choose to download, print, or share the completed form.

Complete your DE 5401(8)CO form online today to streamline your application process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To avoid transfer tax in Delaware, you might explore exemptions such as those for family transfers and transactions involving trusts. Additionally, certain programs assist first-time home buyers in reducing their costs. Carefully assessing the DE 5401(8)CO can help identify your options. Consider using US Legal Forms to ensure you have the correct documentation and information needed to navigate these tax regulations.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.