Loading

Get Ak Dor 661 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AK DoR 661 online

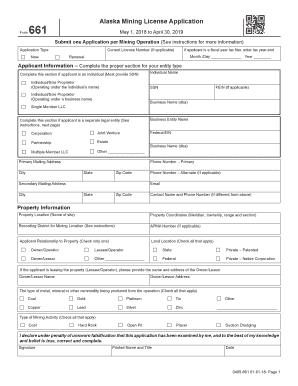

Filling out the AK DoR 661 form is an essential step in applying for a mining license in Alaska. This guide provides clear, step-by-step instructions to assist users in completing the form accurately and efficiently, ensuring a smooth application process.

Follow the steps to successfully complete the AK DoR 661 application.

- Click the ‘Get Form’ button to access the application form and open it in your preferred editing tool.

- Select the application type. Indicate whether you are submitting a new application or a renewal by checking the appropriate box.

- If applicable, provide your current license number and enter the tax year-end date if you are a fiscal year tax filer.

- Complete the applicant information section. If you are an individual, fill in your Social Security Number (SSN). If operating under a business name, provide the business entity name and Federal Employer Identification Number (EIN).

- If you are a legal entity, specify the type of entity (e.g., corporation, partnership, etc.) and include the primary mailing address, phone number, and email.

- Fill out the property information details. Enter the property location, coordinates, recording district, and APMA number if applicable.

- Indicate your relationship to the property by checking one of the options provided, such as Owner/Operator or Lessee/Operator.

- If you are a Lessee/Operator, include the name and address of the Owner/Lessor.

- Specify the types of metal, minerals, or commodities produced from the operation by checking all that apply.

- Select the type of mining activity that you will be engaged in by checking the relevant boxes.

- Finally, sign the declaration stating that the application is true, correct, and complete. Include your printed name, title, and date.

- Once all fields are completed, save your changes, and consider downloading, printing, or sharing the form as needed.

Complete your AK DoR 661 application online today to ensure a timely and accurate submission.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The exact number of 661 AKs is hard to determine due to their limited production and various releases. Collectors track these numbers and they can provide estimates, but it's generally accepted that they are quite rare. Keeping abreast of community discussions can provide more context regarding the AK DoR 661.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.