Loading

Get Fincen 105 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FinCen 105 online

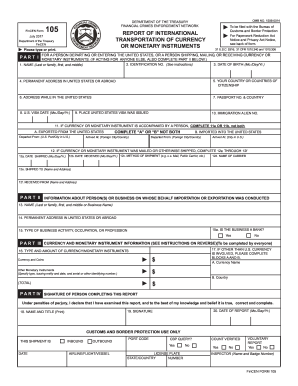

Filling out the FinCen Form 105 is essential for anyone transporting currency or monetary instruments in the United States. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to complete the FinCen 105 form online.

- Press the ‘Get Form’ button to access the FinCen 105 form and open it in your editing platform.

- Begin completing Part I by entering your name. Write your last name, followed by your first name and middle name.

- Fill in your identification number as required, usually your social security number or other specified identification.

- Input your date of birth in the format of month, day, and year.

- Provide your permanent address, whether in the United States or abroad.

- List your country or countries of citizenship.

- If applicable, state your address while in the United States.

- Enter your passport number along with the corresponding country of issuance.

- Indicate your U.S. visa date using the month, day, and year format.

- Mention where your United States visa was issued.

- For people accompanying the transported currency, complete either section 11a or 11b (not both). Include details like the city and country of departure and arrival.

- If the currency or instruments were mailed or shipped, proceed to complete sections 12a through 12f, providing specific details about the shipment.

- In Part II, enter the name of the person or business on whose behalf the transaction was conducted, along with their address.

- State the type of business activity, occupation, or profession related to the transaction.

- In Part III, list the type and amounts of currency or monetary instruments involved, providing necessary details for non-U.S. currencies.

- Complete the signature section in Part IV by signing and dating the form. Include your printed name and title.

- Once all fields are completed, you can save changes, download your document, print, or share the form as needed.

Complete your FinCen 105 form online today to ensure compliance.

Related links form

The limit on FinCen Form 105 pertains to reporting any amount exceeding $10,000 in currency or monetary instruments transported into or out of the U.S. If you are carrying amounts above this threshold, you are required to submit the form. Ensuring accurate reporting protects you from potential legal issues related to financial laws.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.