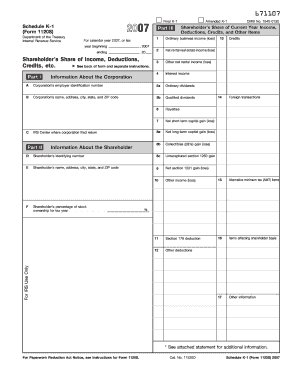

Get Irs 1120s - Schedule K-1 2007

How It Works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Distributions online

How to fill out and sign OMB online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

If you aren?t associated with document managing and legal processes, submitting IRS docs can be extremely difficult. We comprehend the significance of correctly finalizing documents. Our online software proposes the solution to make the mechanism of completing IRS docs as elementary as possible. Follow these tips to properly and quickly fill out IRS 1120S - Schedule K-1.

The way to submit the IRS 1120S - Schedule K-1 on the Internet:

-

Select the button Get Form to open it and begin modifying.

-

Fill out all needed fields in the selected document with our advantageous PDF editor. Switch the Wizard Tool on to complete the process even simpler.

-

Check the correctness of filled info.

-

Add the date of filling IRS 1120S - Schedule K-1. Utilize the Sign Tool to make your unique signature for the document legalization.

-

Finish editing by clicking on Done.

-

Send this record to the IRS in the easiest way for you: through electronic mail, making use of digital fax or postal service.

-

You are able to print it out on paper when a copy is required and download or save it to the preferred cloud storage.

Utilizing our service can certainly make professional filling IRS 1120S - Schedule K-1 a reality. make everything for your comfortable and quick work.

How to edit 11520D: customize forms online

Approve and share 11520D together with any other business and personal paperwork online without wasting time and resources on printing and postal delivery. Take the most out of our online document editor with a built-in compliant eSignature tool.

Signing and submitting 11520D documents electronically is faster and more effective than managing them on paper. However, it requires employing online solutions that ensure a high level of data protection and provide you with a compliant tool for creating electronic signatures. Our powerful online editor is just the one you need to prepare your 11520D and other individual and business or tax forms in a precise and suitable way in line with all the requirements. It offers all the necessary tools to quickly and easily fill out, edit, and sign documentation online and add Signature fields for other people, specifying who and where should sign.

It takes just a few simple steps to complete and sign 11520D online:

- Open the chosen file for further processing.

- Utilize the top toolbar to add Text, Initials, Image, Check, and Cross marks to your sample.

- Underline the important details and blackout or erase the sensitive ones if required.

- Click on the Sign tool above and choose how you want to eSign your sample.

- Draw your signature, type it, upload its picture, or use an alternative option that suits you.

- Move to the Edit Fillable Fileds panel and drop Signature fields for others.

- Click on Add Signer and provide your recipient’s email to assign this field to them.

- Make sure that all information provided is complete and precise before you click Done.

- Share your form with others utilizing one of the available options.

When approving 11520D with our robust online solution, you can always be certain you get it legally binding and court-admissible. Prepare and submit paperwork in the most beneficial way possible!

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Video instructions and help with filling out and completing 453A

Transform an online template into an accurately completed nondeductible in a matter of minutes. Get rid of tedious work — follow the simple recommendations from the video below.

Post-1986 FAQ

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Keywords relevant to IRS 1120S - Schedule K-1

- Reforestation

- noncash

- unrecaptured

- revitalization

- 453A

- nondeductible

- Post-1986

- allocable

- Distributions

- W-2

- CCF

- OMB

- 11520D

- nonqualified

- undistributed

USLegal fulfills industry-leading security and compliance standards.

-

VeriSign secured

#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.

-

Accredited Business

Guarantees that a business meets BBB accreditation standards in the US and Canada.

-

TopTen Reviews

Highest customer reviews on one of the most highly-trusted product review platforms.