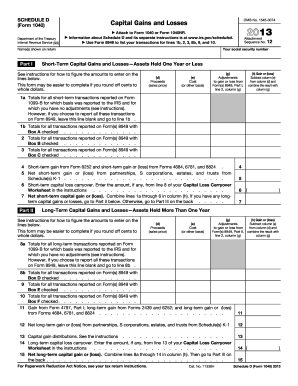

Get Irs 1040 - Schedule D 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Totals online

How to fill out and sign Subtract online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

When the tax season began unplanned or you simply overlooked it, it could likely create issues for you. IRS 1040 - Schedule D isn't the most straightforward form, yet you have no cause for concern regardless.

Utilizing our user-friendly online software, you will discover the optimal approach to complete IRS 1040 - Schedule D, even in moments of severe time pressure. You just need to adhere to these basic instructions:

With our comprehensive digital solution and its advantageous tools, filling out IRS 1040 - Schedule D becomes much simpler. Don’t hesitate to engage with it and allocate more time to your interests instead of document preparation.

- Access the document using our expert PDF editor.

- Complete all the required information in IRS 1040 - Schedule D, utilizing the fillable fields.

- Add images, marks, checkboxes, and text boxes, as needed.

- Recurring details will be entered automatically following the initial submission.

- If you encounter difficulties, activate the Wizard Tool. You will receive helpful hints for simpler completion.

- Remember to provide the filing date.

- Create your distinct signature once and place it in all the necessary fields.

- Review the information you have entered. Rectify errors if needed.

- Click on Done to finalize modifications and select how you will submit it. You can choose to use online fax, USPS, or email.

- Additionally, you can download the document to print it later or upload it to cloud storage services like Google Drive, OneDrive, etc.

How to adjust IRS 1040 - Schedule D 2013: personalize forms online

Select the appropriate IRS 1040 - Schedule D 2013 template and modify it instantly. Streamline your documentation with an intelligent form editing solution for online paperwork.

Your regular workflow with documents and forms can be more productive when you have everything you need centralized. For example, you can locate, obtain, and modify IRS 1040 - Schedule D 2013 within a single browser tab. If you're looking for a specific IRS 1040 - Schedule D 2013, you can effortlessly find it using the intelligent search engine and access it immediately. There's no need to download it or seek a third-party editor to make modifications and input your details. All the tools for efficient work are included in one comprehensive solution.

This editing solution allows you to alter, complete, and sign your IRS 1040 - Schedule D 2013 form instantaneously. When you find a suitable template, click on it to initiate the editing mode. As soon as you open the form in the editor, all the necessary tools are readily available. You can conveniently fill in the designated fields and delete them if required using a user-friendly yet versatile toolbar. Implement all modifications on the spot, and sign the document without leaving the tab by simply clicking the signature area. After that, you can forward or print your document if needed.

Uncover new possibilities for efficient and straightforward documentation. Locate the IRS 1040 - Schedule D 2013 you require in moments and complete it within the same tab. Eliminate the clutter in your paperwork once and for all with the aid of online forms.

- Make additional custom edits with the available tools.

- Annotate your document with the Sticky note feature by placing a note at any location within the document.

- Insert necessary graphic elements, if needed, with the Circle, Check, or Cross tools.

- Alter or add text anywhere in the document using Texts and Text box features. Include content with the Initials or Date tool.

- Change the text in the template with the Highlight, Blackout, or Erase features.

- Include custom graphic components with the Arrow, Line, or Draw tools.

You can find Schedule D within the IRS 1040 tax forms. On the IRS website, it is available for download as part of the package for individual income tax returns. If you use tax software like USB Legal Forms, you can easily access Schedule D through their streamlined platform. This makes it easier to fill out and submit your tax forms accurately.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.