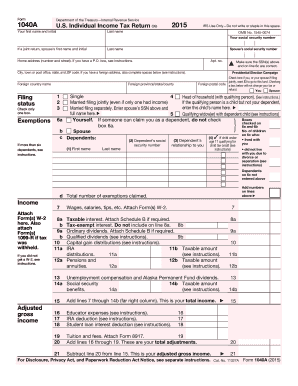

Get Irs 1040-a 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1040-A online

How to fill out and sign IRS 1040-A online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

If the tax filing period commenced unexpectedly or perhaps you simply overlooked it, it could likely lead to complications for you. The IRS 1040-A is not the most straightforward form, but you should not have any reason for concern in any circumstance.

By using our expert online application, you will learn how to complete the IRS 1040-A even in situations of severe time constraints. You only need to adhere to these basic instructions:

With our robust digital solution and its useful tools, filling out the IRS 1040-A becomes simpler. Don’t hesitate to try it and enjoy more time on hobbies and interests rather than on document preparation.

Access the document with our state-of-the-art PDF editor.

Input the necessary information in IRS 1040-A, utilizing the fillable fields.

Insert images, checks, marks, and text boxes if necessary.

Recurring information will be filled in automatically after the initial entry.

If you encounter any challenges, activate the Wizard Tool. You will receive some advice for easier completion.

Remember to include the filing date.

Create your distinct signature once and place it in all the required areas.

Review the information you have entered. Correct any errors if needed.

Click Done to complete editing and choose your preferred method of submission. You will have the option to utilize virtual fax, USPS, or email.

Additionally, you can download the document for future printing or upload it to cloud storage such as Google Drive, Dropbox, etc.

How to modify IRS 1040-A 2015: personalize documents online

Complete and endorse your IRS 1040-A 2015 efficiently and without mistakes. Locate and adjust, and approve customizable document templates within the convenience of a single tab.

Your document management process can be significantly more productive if all necessary elements for modification and oversight are consolidated in one location. If you are looking for an IRS 1040-A 2015 form example, this is the destination to obtain it and complete it without seeking external solutions. With this advanced search tool and editing application, you won’t need to search any further.

Simply enter the title of the IRS 1040-A 2015 or any other document and discover the appropriate example. If the example appears suitable, you can commence editing it right away by clicking Get form. There’s no requirement to print or even download it. Hover and select the interactive fillable areas to input your information and sign the document within a single editor.

Utilize additional editing tools to personalize your document: Check interactive checkboxes in documents by selecting them. Review other sections of the IRS 1040-A 2015 form text with the help of the Cross, Check, and Circle tools.

Incorporate custom features such as Initials or Date using the specified tools. They will be produced automatically. Preserve the document on your device or convert its format to your desired one. When empowered with a smart forms collection and an effective document editing tool, managing paperwork is simpler. Locate the form you need, complete it promptly, and sign it on the spot without downloading. Streamline your paperwork process with a solution tailored for document editing.

- If you need to insert additional written content into the file, use the Text tool or add fillable fields with the corresponding button.

- You can even specify the content of each fillable field.

- Include images in documents with the Image button.

- Import images from your device or capture them using your computer's camera.

- Incorporate custom visual components into the file. Use Draw, Line, and Arrow tools to illustrate on the document.

- Illustrate over the text in the file if you wish to obscure it or emphasize it.

- Conceal text segments using the Erase and Highlight, or Blackout tools.

You can request a copy of your IRS 1040-A online through the IRS portal. After verifying your identity, you can choose to receive your copy by mail or download it directly. Additionally, if you find this process confusing, platforms like US Legal Forms can offer guidance and streamline your request for a copy of your tax form.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.