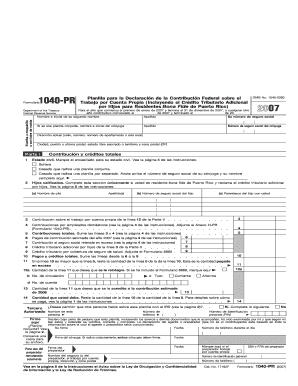

Get Irs 1040-pr 2007

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1040-PR online

How to fill out and sign IRS 1040-PR online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

If the tax period commenced unexpectedly or perhaps you just overlooked it, it might likely lead to complications for you. IRS 1040-PR is not the simplest form, but there is no need for alarm in any situation.

By utilizing our ultimate service, you will grasp the proper method to complete IRS 1040-PR in scenarios of significant time constraints. All you have to do is adhere to these simple instructions:

With this robust digital solution and its beneficial tools, completing IRS 1040-PR becomes more convenient. Don't hesitate to try it and spend more time on your hobbies and interests instead of preparing documents.

Access the document using our expert PDF editor.

Input all the necessary information in IRS 1040-PR, utilizing the fillable fields.

Insert images, marks, checkboxes, and text fields, if necessary.

Repeated information will be populated automatically after the initial entry.

If you face any issues, activate the Wizard Tool. You will receive beneficial advice for much simpler submission.

Always remember to include the filing date.

Create your distinctive e-signature once and place it in the required fields.

Verify the details you have provided. Amend errors if necessary.

Press Done to finalize your modifications and choose your method of submission. You will have the option to use virtual fax, USPS, or electronic mail.

You can also download the document to print it later or upload it to cloud storage services like Google Drive, Dropbox, etc.

How to Modify Get IRS 1040-PR 2007: Personalize Forms Online

Utilize our comprehensive online document editor while finalizing your forms. Complete the Get IRS 1040-PR 2007, highlight the most important details, and seamlessly make any other required alterations to its content.

Creating documents digitally is not only efficient but also provides the opportunity to adjust the template to meet your needs. If you're preparing to handle the Get IRS 1040-PR 2007, consider filling it out with our powerful online editing tools. Whether you've made a mistake or entered the required information in the incorrect field, you can swiftly amend the form without needing to restart from scratch as you would with a paper fill-out. Additionally, you can indicate the crucial information in your documents by highlighting specific pieces of content with colors, underlining, or circling them.

Follow these quick and straightforward steps to complete and edit your Get IRS 1040-PR 2007 online:

Our extensive online tools are the easiest method to complete and modify the Get IRS 1040-PR 2007 tailored to your requirements. Use it to manage personal or professional documents from any location. Open it in a browser, make any edits to your files, and return to them at any time in the future - they will all be safely stored in the cloud.

- Access the file in the editor.

- Input the required data in the empty fields using Text, Check, and Cross features.

- Follow the document navigation to ensure you don't overlook any necessary sections in the template.

- Circle some of the vital details and add a URL to it if required.

- Utilize the Highlight or Line options to bring attention to the most important facts.

- Select colors and thickness for these lines to enhance the professional appearance of your sample.

- Delete or obscure the information you wish to keep hidden from others.

- Replace portions of content containing mistakes and input the text that you need.

- Conclude modifications with the Done option once you confirm everything is accurate in the document.

Related links form

Puerto Rico residents typically do not file IRS Form 1040, but rather use IRS Form 1040-PR. This form is specifically designed for their unique tax situation. Filing the correct form ensures that they comply with both local and federal tax laws. Understanding the benefits of IRS 1040-PR helps residents navigate their tax obligations effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.