Get Irs 1040-ss 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040-SS online

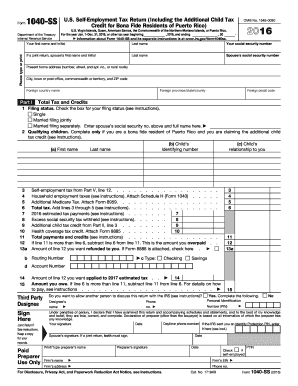

The IRS 1040-SS form is designed for self-employed individuals in U.S. territories, including Puerto Rico. This guide provides a step-by-step approach to filling out the form online, ensuring you understand each component and can complete your tax return accurately.

Follow the steps to complete the IRS 1040-SS form online.

- Press the ‘Get Form’ button to access the IRS 1040-SS form and open it in your preferred online document editor.

- Input your personal information in the first section, including your first name, last name, and social security number. If filing jointly, enter your partner’s details as well.

- In Part I, select your filing status by checking the appropriate box. This section requires you to choose from single, married filing jointly, or married filing separately.

- If claiming the additional child tax credit as a bona fide resident of Puerto Rico, complete the qualifying children section by providing their names, identifying numbers, and your relationship to them.

- Continue entering your tax and credits information on lines 3 through 10, including self-employment tax, household employment taxes, and additional Medicare tax if applicable.

- Calculate your total payments and credits based on the information provided, making sure to check for any overpayment or amount owed.

- In the signature section, ensure you sign and date the form, and if applicable, include your partner's signature for joint returns.

- Once all sections are completed and reviewed, save your changes, and choose to download, print, or share your completed form as required.

Complete the IRS 1040-SS form online today to ensure your self-employment taxes are filed accurately.

Get form

Related links form

Tax form 1040PR is similar to the 1040-SS, but it caters specifically to residents of Puerto Rico who need to report additional income types and claim various credits. Utilizing the 1040PR allows you to account for income earned outside of Puerto Rico and helps ensure compliance with both IRS and Puerto Rican tax laws. Consider using IRS 1040-SS if you have income solely from sources within Puerto Rico.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.