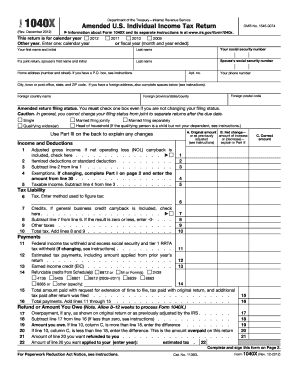

Get Irs 1040-x 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1040-X online

How to fill out and sign IRS 1040-X online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

When the tax filing period begins unexpectedly or perhaps you simply overlooked it, it may lead to issues for you. The IRS 1040-X form is not the most straightforward, but there is no need for concern in any case.

With our ultimate service, you will learn how to fill out IRS 1040-X in cases of urgent time constraints. You just need to adhere to these straightforward instructions:

By utilizing our comprehensive digital solution and its effective tools, completing IRS 1040-X becomes simpler. Don't hesitate to try it and focus more on your hobbies and passions instead of handling paperwork.

- Open the file with our robust PDF editor.

- Complete all necessary information on IRS 1040-X, using the fillable fields.

- Include graphics, marks, checkboxes, and text boxes, when necessary.

- Repetitive fields will be inserted automatically after the initial entry.

- If you encounter difficulties, activate the Wizard Tool. You will receive guidance for easier completion.

- Remember to input the application date.

- Create your unique electronic signature once and place it in the required areas.

- Review the information you have entered. Make corrections if needed.

- Click Done to complete the editing and select your method of submission. You will have options to use digital fax, USPS, or email.

- You have the option to download the document for printing later or upload it to cloud services like Google Drive, Dropbox, etc.

How to Alter Get IRS 1040-X 2012: Personalize Forms Online

Explore a single solution to manage all your documents with simplicity. Locate, alter, and complete your Get IRS 1040-X 2012 in one platform using advanced tools.

The days when individuals had to print forms or fill them out by hand are finished. Nowadays, all it requires to obtain and finalize any form, such as Get IRS 1040-X 2012, is opening just one browser tab. Here, you can access the Get IRS 1040-X 2012 form and tailor it any way you require, from inserting text directly into the document to sketching it on a digital sticky note and attaching it to the file. Discover tools that will simplify your paperwork with minimal effort.

Just click the Get form button to prepare your Get IRS 1040-X 2012 documents quickly and start adjusting it right away. In the editing mode, you can easily fill the template with your details for submission. Just click on the field you wish to modify and input the information immediately. The editor's interface does not require any special skills to navigate. Once you finish the adjustments, verify the information's correctness once more and sign the document. Click on the signature field and follow the prompts to electronically sign the form in no time.

Utilize additional tools to personalize your form:

Completing Get IRS 1040-X 2012 forms will never be confusing again if you know where to locate the appropriate template and complete it easily. Do not hesitate to give it a try yourself.

- Use Cross, Check, or Circle tools to specify the document's data.

- Incorporate text or fillable fields with text customization tools.

- Remove, Highlight, or Blackout text segments in the document using respective tools.

- Insert a date, initials, or even an image into the document if needed.

- Employ the Sticky note tool to comment on the form.

- Utilize the Arrow and Line, or Draw tool to add graphic elements to your document.

Related links form

As of now, you can file the IRS 1040-X electronically through approved tax software that integrates with IRS e-filing. This option simplifies the submission process and speeds up processing times. Using platforms like uslegalforms often streamlines this electronic filing, ensuring you submit accurately and efficiently.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.