Loading

Get Irs 1041 2013

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1041 online

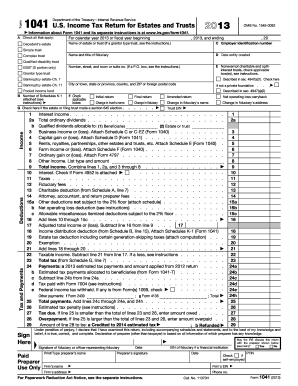

The IRS 1041 form is essential for reporting income, deductions, and tax liability for estates and trusts. This guide provides comprehensive steps to help users fill out the form accurately and efficiently online.

Follow the steps to complete the IRS 1041 online with ease.

- Click the ‘Get Form’ button to access the IRS 1041 form and open it in your preferred online editor.

- Fill out your basic information. Indicate whether you are filing for a decedent's estate or a type of trust. Enter the name of the estate or trust and its Employer Identification Number (EIN).

- Provide the fiduciary's name, title, and the date the entity was created. This ensures proper identification for the IRS.

- Check the boxes that apply to your filing situation, including whether it is an initial, final, or amended return. Indicate any changes to the fiduciary's name or address.

- Complete the income section, listing all sources of income such as dividends and capital gains. Use the relevant schedules as instructed to ensure accuracy.

- Fill out the deductions section, including fiduciary fees and any charitable contributions made from the estate. Attach the necessary schedules to substantiate these claims.

- Calculate the total tax owed or the overpayment by following the provided instructions. Make sure to add all relevant lines to determine the final figures.

- Once all sections are completed, review the entire form for accuracy. Make any necessary corrections before proceeding.

- Save your changes to the online document. You have the option to download, print, or share the completed form as needed.

Complete your IRS 1041 form online today to ensure timely and accurate filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Fiduciaries handling estates or trusts must file an IRS form 1041 if certain income thresholds are met. This includes executors of estates and trustees who administer trust funds. Each must ensure compliance with filing requirements to avoid legal troubles. Let US Legal Forms guide you through the filing process with ease.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.