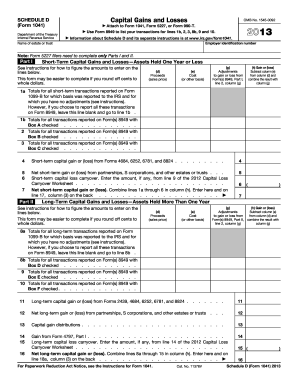

Get Irs 1041 - Schedule D 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Form1041 online

How to fill out and sign Taxable online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

If the tax period started unexpectedly or you simply overlooked it, it would likely create issues for you. IRS 1041 - Schedule D is not the easiest one, but there's no need to panic in any situation.

By utilizing our user-friendly solution, you will learn how to complete IRS 1041 - Schedule D even in circumstances of significant time shortage. You just have to adhere to these straightforward instructions:

With our all-inclusive digital solution and its beneficial tools, submitting IRS 1041 - Schedule D becomes easier. Don’t hesitate to engage with it and allocate more time to leisure activities rather than handling paperwork.

Access the document with our sophisticated PDF editor.

Input the necessary details in IRS 1041 - Schedule D, using fillable fields.

Add images, crosses, check and text boxes, if required.

Repeating information will automatically be populated after the initial entry.

If you encounter challenges, use the Wizard Tool. You will see some hints for smoother completion.

Don’t forget to indicate the filing date.

Create your distinctive e-signature once and place it in the designated areas.

Verify the information you've entered. Rectify any errors if necessary.

Click on Done to complete editing and select how you will submit it. You will have options to use digital fax, USPS, or email.

You can also download the file to print later or upload it to cloud storage such as Google Drive, Dropbox, etc.

How to Alter Get IRS 1041 - Schedule D 2013: Personalize Forms Online

Utilize our extensive editor to convert a basic online template into a finished document. Continue reading to find out how to modify Get IRS 1041 - Schedule D 2013 online effortlessly.

Once you find an ideal Get IRS 1041 - Schedule D 2013, all that remains is to tailor the template to your specifications or legal obligations. Besides filling out the editable form with precise information, you may need to eliminate some clauses in the document that do not pertain to your situation. Conversely, you might wish to insert some omitted terms in the original template. Our sophisticated document editing features are the most straightforward method to edit and amend the document.

The editor allows you to alter the content of any form, even if the document is in PDF format. You can add and remove text, insert fillable fields, and make further modifications while retaining the original formatting of the document. You can also rearrange the layout of the document by adjusting the page sequence.

You don’t have to print the Get IRS 1041 - Schedule D 2013 to sign it. The editor includes electronic signature functionality. Most forms already contain signature fields. Therefore, you just need to add your signature and request one from the other signing party with a few clicks.

Follow this step-by-step guide to create your Get IRS 1041 - Schedule D 2013:

Once all parties finalize the document, you will receive a signed copy which you can download, print, and share with others.

Our solutions enable you to save substantial time and minimize the possibility of errors in your documents. Streamline your document workflows with effective editing capabilities and a robust eSignature solution.

- Open the selected template.

- Utilize the toolbar to adapt the form to your preferences.

- Complete the form with accurate details.

- Click on the signature field and insert your electronic signature.

- Send the document for signature to additional signers if necessary.

Related links form

Form 1120 Schedule D is used by corporations to report capital gains and losses, similar to how individuals use Schedule D for their IRS filings. When handling corporate taxes, it is important to distinguish between Form 1041 for estates and Form 1120 for corporations, each requiring its own Schedule D. This allows for proper reporting of tax obligations based on the entity type.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.