Loading

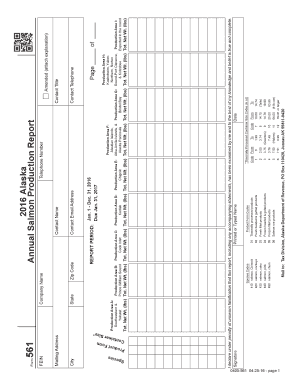

Get Ak Form 561 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AK Form 561 online

Filling out the AK Form 561 online can seem daunting, but with clear guidance, you can navigate the process with ease. This guide will provide you with step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the form successfully.

- Press the ‘Get Form’ button to access the form and open it in your online editor.

- Begin by entering your company name in the specified field. Ensure that the name is correctly spelled to avoid any processing issues.

- Next, provide your mailing address, including your city, state, zip code, and contact telephone. This information is vital for any follow-up inquiries.

- Enter your FEIN (Federal Employer Identification Number), which can be obtained from your tax documents if you do not have it readily available.

- Indicate the report period, which in this case is Jan. 1 - Dec. 31, 2016. Ensure that this date range aligns with your production activity.

- Fill out the total net weight for each production area, from A to I. Be precise with the figures to reflect your actual production.

- Total the weights accurately as this information is crucial for reporting.

- Select the appropriate species codes for the salmon varieties produced. Familiarize yourself with the codes provided in the form to ensure correct selection.

- For product form, indicate the type of processed salmon produced, using the corresponding product code that matches your output.

- After completing all required fields, review the information entered for accuracy. This step is essential to prevent errors before submission.

- Save your changes, and you can then choose to download, print, or share the completed form as needed.

Complete your AK Form 561 online today for a streamlined submission process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To obtain a K1 tax form, you typically need to contact the partnership or entity that issued the form. They should provide you with a copy based on your share in the business. Keep in mind that you may also need to check your tax documents or accounting software if you use one. If you face difficulties, consider using the US Legal Forms platform for assistance with tax-related forms, including the AK Form 561.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.