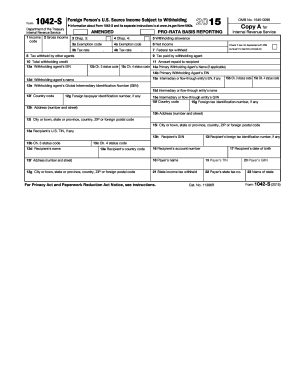

Get Irs 1042-s 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1042-S online

The IRS 1042-S is a crucial form for reporting U.S. source income paid to foreign persons subject to withholding. This guide provides step-by-step instructions on how to effectively complete this form online, ensuring your submission is accurate and compliant with IRS regulations.

Follow the steps to accurately complete the IRS 1042-S online.

- Click 'Get Form' button to obtain the form and open it in the online editor.

- Identify the income section where you will report the specific type of income. This includes selecting the appropriate income code from the options provided based on the nature of income being reported.

- Enter the gross income amount in the designated field, ensuring it accurately reflects the total income subject to withholding.

- If applicable, input the exemption code to indicate any exemptions that apply to the income being reported, and ensure you check any necessary boxes related to tax withholding.

- Fill in the withholding allowance if you are providing information related to any decreases in withholding due to tax treaty benefits.

- Complete the tax withheld section, detailing the amount that has been withheld based on the rates applicable to the reporting period.

- Provide identifying information for the withholding agent, including their name, Employer Identification Number (EIN), and any intermediary or flow-through entity details if relevant.

- Fill in the recipient's details, including their name, address, and any applicable Taxpayer Identification Number (TIN) or foreign tax identification number.

- Review all entered data for accuracy, ensuring compliance with the IRS requirements.

- Once completed, save your changes, and then you may download, print, or share the form as needed.

Take the next step in your tax preparation and complete your IRS 1042-S online today.

Get form

Related links form

Yes, the IRS has systems in place to identify individuals and entities that fail to file required forms, including the IRS 1042-S. They may match income reported on your 1042-S against your tax returns, leading to potential audits or penalties for unreported income. To avoid these risks, it is always better to file all necessary forms accurately. Working with a professional can help you ensure compliance.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.