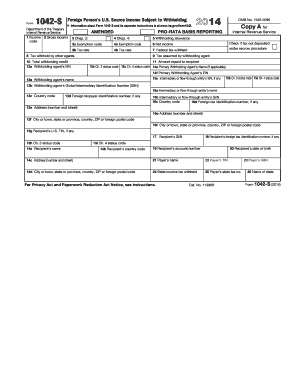

Get Irs 1042-s 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1042-S online

How to fill out and sign IRS 1042-S online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

If the taxation period commenced unexpectedly or perhaps you simply overlooked it, it may likely cause issues for you. IRS 1042-S is not the easiest form, but there is no reason to be anxious in any situation.

By using our ultimate online application, you will grasp how to fill out IRS 1042-S in cases of significant time shortages. Just follow these straightforward steps:

With this robust digital solution and its professional tools, submitting IRS 1042-S becomes more efficient. Don't hesitate to try it and allocate more time to hobbies and interests rather than document preparation.

- Open the document with our sophisticated PDF editor.

- Complete all the necessary information in IRS 1042-S, using the fillable fields.

- Insert images, checkmarks, tick boxes, and text boxes if needed.

- Repetitive fields will automatically fill after the initial entry.

- If you encounter any issues, activate the Wizard Tool. You will receive tips for easier completion.

- Always remember to include the application date.

- Create your unique signature once and place it in the required fields.

- Review the information you have entered. Amend any errors if needed.

- Click Done to finish editing and choose how you will submit it. You can use virtual fax, USPS, or email.

- You can download the document to print it later or upload it to cloud storage such as Google Drive, OneDrive, etc.

How to Alter Get IRS 1042-S 2014: Personalize Forms Online

Eliminate the clutter from your documentation routine. Uncover the easiest way to locate, modify, and submit a Get IRS 1042-S 2014.

The task of preparing Get IRS 1042-S 2014 requires precision and focus, particularly for individuals who are not very acquainted with this kind of work. It is crucial to select an appropriate template and complete it with accurate details. With the proper solution for managing documentation, you can have all the tools at your disposal. It is easy to optimize your editing procedure without acquiring new skills. Locate the right model of Get IRS 1042-S 2014 and fill it out swiftly without toggling between your web browser tabs. Discover additional tools to tailor your Get IRS 1042-S 2014 form in the editing mode.

While on the Get IRS 1042-S 2014 page, simply click the Get form button to commence editing it. Input your information into the form directly, as all the necessary tools are readily available. The template is pre-structured, so the effort required from the user is minimal. Just utilize the interactive fillable fields in the editor to effortlessly complete your documentation. Merely click on the form and move to the editor mode immediately. Fill out the interactive field, and your document is ready to go.

Explore more tools to personalize your form:

Sometimes, a minor mistake can compromise the entire form when someone fills it out manually. Say goodbye to errors in your paperwork. Find the necessary samples swiftly and complete them electronically through an intelligent editing solution.

- Add more written content around the document if desired. Use the Text and Text Box tools to insert text in a separate box.

- Include pre-designed visual components like Circle, Cross, and Check with the respective instruments.

- If needed, capture or upload images to the document using the Image tool.

- If you need to sketch something in the document, use Line, Arrow, and Draw tools.

- Utilize the Highlight, Erase, and Blackout tools to modify the text in the document.

- If you require to add remarks to specific parts of the document, click on the Sticky tool and place a note wherever needed.

Related links form

You report your IRS 1042-S income on your federal tax return, typically on Form 1040NR for non-resident aliens. Look for the section designated for reporting income from foreign sources or any specific line instructed for this purpose. If you're using tax software, they will often provide prompts to ensure you're reporting accurately. Familiarizing yourself with this process enhances your confidence in managing tax matters.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.