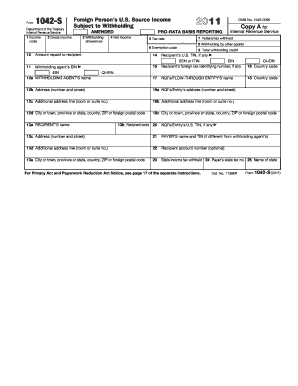

Get Irs 1042-s 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1042-S online

How to fill out and sign IRS 1042-S online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

When the tax period initiated unexpectedly or you simply overlooked it, it could likely lead to complications for you.

IRS 1042-S is not the most straightforward form, but there is no need for concern in any scenario.

With our comprehensive digital solution and its beneficial tools, submitting IRS 1042-S becomes easier. Don’t hesitate to give it a try and free up more time for hobbies and interests instead of document preparation.

- Access the document using our expert PDF editor.

- Complete the required information in IRS 1042-S, utilizing the fillable fields.

- Incorporate images, marks, checkboxes, and text boxes, if desired.

- Repeating input fields will be automatically generated following the initial entry.

- If you encounter any issues, activate the Wizard Tool. You will receive guidance for more effortless completion.

- Remember to include the date of submission.

- Create your unique electronic signature once and place it in the necessary spots.

- Review the information you have entered. Correct errors if necessary.

- Click Done to complete editing and select your preferred method of submission. You will have the option to use virtual fax, USPS, or email.

- You can download the document for later printing or upload it to cloud storage services like Dropbox, OneDrive, etc.

How to alter Get IRS 1042-S 2011: personalize forms online

Select a reliable file modification service you can depend on. Alter, implement, and validate Get IRS 1042-S 2011 securely online.

Frequently, altering documents, such as Get IRS 1042-S 2011, can pose a challenge, particularly if you received them digitally but lack access to specialized tools. Certainly, there are some alternatives to bypass this issue, but you might end up with a form that doesn't meet submission criteria. Utilizing a printer and scanner isn’t a solution either, since it's time- and resource-consuming.

We present a more seamless and effective method of completing forms. An extensive range of document templates that are easy to personalize and validate, and make fillable for certain users. Our platform goes beyond merely a collection of templates. One of the most advantageous aspects of using our service is that you can modify Get IRS 1042-S 2011 directly on our website.

Being an online-based solution, it spares you the need to download any software. Moreover, not all company policies allow you to install it on your corporate devices. Here’s the optimal way to easily and securely process your forms with our service.

Bid farewell to paper and other inefficient methods of processing your Get IRS 1042-S 2011 or other documents. Opt for our solution instead, which boasts one of the most extensive libraries of ready-to-customize templates and a robust file editing feature. It's simple and secure, and can save you a substantial amount of time! Don’t just take our word for it, try it yourself!

- Click the Get Form > to be quickly redirected to our editor.

- Once opened, you can begin the editing process.

- Choose checkmark or circle, line, arrow and cross and other selections to annotate your document.

- Select the date option to add a specific date to your template.

- Insert text boxes, images, notes, and more to enhance the content.

- Utilize the fillable fields option on the right to create fillable fields.

- Choose Sign from the top toolbar to generate your legally-binding signature.

- Click DONE and save, print, and share or download the final output.

Related links form

To file an IRS 1042-S tax return, ensure you complete the appropriate forms, which usually involves filing Form 1040-NR if you are a non-resident alien. You will gather information from your 1042-S and other relevant documents. For assistance, consider using platforms like uslegalforms, which can guide you through the filing process and ensure all details are accurately reported.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.