Loading

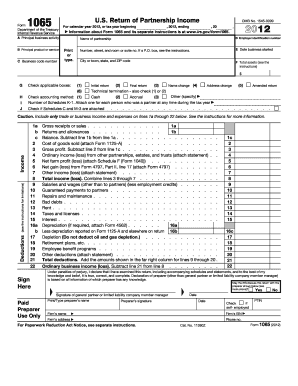

Get Irs 1065 2012

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1065 online

The IRS Form 1065 is used to report the income, deductions, gains, and losses of a partnership. Completing this form online can streamline the process and ensure accuracy. This guide will walk you through each section of the form, providing clear and concise instructions tailored for all users.

Follow the steps to complete your IRS 1065 successfully

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide the principal business activity of the partnership by filling in the relevant field. You should also specify the principal product or service offered by your business.

- Enter the business code number to classify the type of business. This number can be found in the IRS instructions for Form 1065.

- Fill in the partnership's name and employer identification number (EIN). Provide the address, including street number, city, state, and ZIP code.

- Indicate the date the business started. This information is important for determining the partnership's tax obligations.

- Record total assets as required by the instructions provided on the form. This value represents the entirety of your business's assets.

- Check the appropriate boxes regarding the nature of the return, such as initial return, final return, or name change, as applicable.

- Indicate your accounting method (either cash or accrual) by selecting the appropriate option.

- Complete the income and deductions sections by entering the total income, cost of goods sold, and various expenses. Ensure all numbers are accurate and match your records.

- At the end of the form, have a general partner or a member-manager sign and date the form, certifying its accuracy.

- Once all required sections are filled out, review the entire document for any errors. After confirming its completeness, you can choose to save the changes, download, print, or share the completed form as needed.

Complete your IRS forms online today to ensure accuracy and streamline your filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Any partnership engaged in business activities that has income, deductions, or credits must file form 1065. This includes general partnerships, limited partnerships, and certain LLCs. Understanding your obligation is vital to avoid complications in your tax filings.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.