Loading

Get Irs 6765 2019

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 6765 online

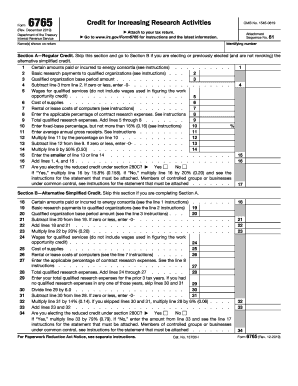

The IRS 6765 form, titled 'Credit for Increasing Research Activities,' is essential for anyone looking to claim a tax credit for their research and development efforts. This guide provides clear instructions to help users navigate the form online efficiently.

Follow the steps to complete the IRS 6765 online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Begin by filling out your identifying information, including the name shown on your tax return and your identifying number.

- Section A deals with the Regular Credit. If you are opting for the alternative simplified credit, you can skip this section and go to Section B.

- In Section A, enter any amounts paid or incurred to energy consortia on line 1, and basic research payments to qualified organizations on line 2.

- Calculate the qualified organization base period amount on line 3, then proceed to enter wages for qualified services on line 4.

- Enter the costs of supplies on line 5, rental or lease costs of computers on line 6, and applicable percentage of contract research expenses on line 7.

- Add lines 5 through 8 to determine total qualified research expenses on line 8.

- Enter the fixed-base percentage on line 9, and calculate your average annual gross receipts on line 10.

- Use these calculations to fill in the remaining fields, including credit amounts and any elections under section 280C.

- If you are using Section B for the Alternative Simplified Credit, enter the relevant amounts and perform similar calculations as in Section A.

- In Section C, provide information regarding the current year credit and its allocation.

- If applicable, complete Section D for Qualified Small Business Payroll Tax Election, ensuring you follow any relevant instructions.

- Once all sections are completed, review the form for accuracy, then save your changes and proceed to download, print, or share your filled form as needed.

Complete your IRS 6765 form online today for a smoother filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Eligible parties for the R&D tax credit include corporations, partnerships, and certain small businesses conducting qualifying research activities. If your work involves technological advancements, you likely meet the criteria. The IRS 6765 is the key tool to claim these credits and maximize your tax savings.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.