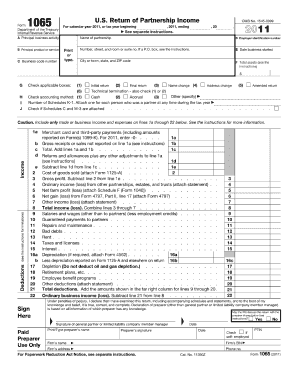

Get Irs 1065 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign 17a online

How to fill out and sign 16C online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

When the tax period began unexpectedly or maybe you just forgot about it, it could probably cause problems for you. IRS 1065 is not the easiest one, but you have no reason for panic in any case.

Making use of our powerful on-line software you will see the right way to fill up IRS 1065 in situations of critical time deficit. You simply need to follow these elementary instructions:

-

Open the record using our advanced PDF editor.

-

Fill in all the details required in IRS 1065, making use of fillable fields.

-

Insert pictures, crosses, check and text boxes, if you need.

-

Repeating information will be added automatically after the first input.

-

If you have any difficulties, turn on the Wizard Tool. You will see some tips for easier completion.

-

Never forget to include the date of filing.

-

Create your unique signature once and place it in all the required fields.

-

Check the details you have included. Correct mistakes if necessary.

-

Click Done to complete editing and choose how you will send it. You will have the ability to use virtual fax, USPS or e-mail.

-

You are able to download the file to print it later or upload it to cloud storage like Dropbox, OneDrive, etc.

With our powerful digital solution and its useful instruments, filling out IRS 1065 becomes more handy. Don?t hesitate to use it and have more time on hobbies rather than on preparing files.

How to edit M-2: customize forms online

Select a reliable file editing solution you can trust. Revise, execute, and sign M-2 safely online.

Very often, modifying forms, like M-2, can be a challenge, especially if you got them in a digital format but don’t have access to specialized software. Of course, you can use some workarounds to get around it, but you risk getting a form that won't fulfill the submission requirements. Using a printer and scanner isn’t a way out either because it's time- and resource-consuming.

We provide an easier and more streamlined way of modifying files. A rich catalog of document templates that are easy to edit and certify, to make fillable for others. Our solution extends way beyond a set of templates. One of the best aspects of utilizing our option is that you can revise M-2 directly on our website.

Since it's a web-based option, it spares you from having to download any software program. Additionally, not all company rules allow you to download it on your corporate computer. Here's the best way to effortlessly and safely execute your forms with our solution.

- Hit the Get Form > you’ll be instantly taken to our editor.

- As soon as opened, you can start the customization process.

- Choose checkmark or circle, line, arrow and cross and other options to annotate your form.

- Pick the date option to add a specific date to your template.

- Add text boxes, graphics and notes and more to enrich the content.

- Use the fillable fields option on the right to add fillable {fields.

- Choose Sign from the top toolbar to generate and add your legally-binding signature.

- Click DONE and save, print, and share or download the document.

Say goodbye to paper and other inefficient ways of completing your M-2 or other documents. Use our tool instead that combines one of the richest libraries of ready-to-customize forms and a robust file editing option. It's easy and safe, and can save you lots of time! Don’t take our word for it, try it out yourself!

Related links form

The IRS 1065 form is a tax return specifically designed for partnerships to report income, deductions, and other financial activities. This form allows partners to report their share of the income and expenses on their individual tax returns. Understanding the IRS 1065 form is essential for compliance and effective business management.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.