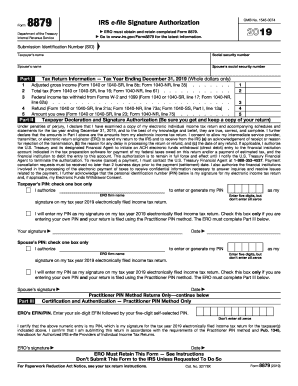

Get Irs 8879 2019-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 8879 online

How to fill out and sign IRS 8879 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

When you aren?t associated with document administration and legal procedures, submitting IRS forms can be susprisingly exhausting. We understand the importance of correctly completing documents. Our service offers the solution to make the procedure of processing IRS documents as elementary as possible. Follow these guidelines to quickly and properly submit IRS 8879.

How you can submit the IRS 8879 online:

-

Click on the button Get Form to open it and start editing.

-

Fill in all necessary fields in the file making use of our advantageous PDF editor. Turn the Wizard Tool on to complete the process even easier.

-

Make sure about the correctness of filled information.

-

Add the date of finishing IRS 8879. Utilize the Sign Tool to make an individual signature for the file legalization.

-

Finish modifying by clicking Done.

-

Send this document to the IRS in the most convenient way for you: via e-mail, using digital fax or postal service.

-

You can print it on paper if a hard copy is needed and download or save it to the preferred cloud storage.

Making use of our online software can certainly make professional filling IRS 8879 a reality. We will make everything for your comfortable and easy work.

How to edit IRS 8879: customize forms online

Check out a single service to deal with all of your paperwork effortlessly. Find, edit, and finish your IRS 8879 in a single interface with the help of smart tools.

The times when people needed to print forms or even write them by hand are over. These days, all it takes to find and finish any form, like IRS 8879, is opening a single browser tab. Here, you can find the IRS 8879 form and customize it any way you need, from inserting the text directly in the document to drawing it on a digital sticky note and attaching it to the document. Discover tools that will simplify your paperwork without extra effort.

Click on the Get form button to prepare your IRS 8879 paperwork easily and start editing it instantly. In the editing mode, you can easily complete the template with your information for submission. Just click on the field you need to modify and enter the information right away. The editor's interface does not demand any specific skills to use it. When done with the edits, check the information's accuracy once more and sign the document. Click on the signature field and follow the instructions to eSign the form in a moment.

Use Additional tools to customize your form:

- Use Cross, Check, or Circle tools to pinpoint the document's data.

- Add textual content or fillable text fields with text customization tools.

- Erase, Highlight, or Blackout text blocks in the document using corresponding tools.

- Add a date, initials, or even an image to the document if necessary.

- Use the Sticky note tool to annotate the form.

- Use the Arrow and Line, or Draw tool to add visual components to your document.

Preparing IRS 8879 forms will never be perplexing again if you know where to look for the suitable template and prepare it effortlessly. Do not hesitate to try it yourself.

IRS form 8879 is the e-file Signature Authorization form used by taxpayers to electronically sign their tax returns. By signing this form, taxpayers authorize their tax preparers to file returns on their behalf, streamlining the overall e-filing process. Familiarizing yourself with IRS 8879 can make your tax season much smoother.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.