Get Irs W-4(sp) 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS W-4(SP) online

How to fill out and sign IRS W-4(SP) online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Confirming your income and submitting all the essential taxation reports, including IRS W-4(SP), is a US citizen?s exclusive responsibility. US Legal Forms tends to make your tax managing a lot more available and efficient. You can get any legal samples you require and fill out them in electronic format.

How to complete IRS W-4(SP) online:

-

Get IRS W-4(SP) within your web browser from your device.

-

Gain access to the fillable PDF document with a click.

-

Start completing the web-template field by field, using the prompts of the advanced PDF editor?s interface.

-

Precisely enter textual information and numbers.

-

Tap the Date box to place the current day automatically or alter it manually.

-

Use Signature Wizard to make your personalized e-signature and certify in seconds.

-

Use the IRS instructions if you still have questions..

-

Click on Done to confirm the revisions..

-

Go on to print the file out, save, or share it via Email, text message, Fax, USPS without exiting your browser.

Keep your IRS W-4(SP) securely. Make sure that all your appropriate paperwork and data are in are in right place while remembering the deadlines and tax rules established with the Internal Revenue Service. Make it simple with US Legal Forms!

How to edit IRS W-4(SP): customize forms online

Make the best use of our extensive online document editor while preparing your paperwork. Complete the IRS W-4(SP), point out the most important details, and effortlessly make any other essential changes to its content.

Preparing documents electronically is not only time-saving but also gives an opportunity to edit the template according to your needs. If you’re about to manage the IRS W-4(SP), consider completing it with our extensive online editing tools. Whether you make an error or enter the requested information into the wrong field, you can easily make adjustments to the form without the need to restart it from the beginning as during manual fill-out. In addition to that, you can point out the essential information in your paperwork by highlighting particular pieces of content with colors, underlining them, or circling them.

Adhere to these quick and simple steps to complete and adjust your IRS W-4(SP) online:

- Open the form in the editor.

- Provide the necessary information in the empty areas using Text, Check, and Cross tools.

- Adhere to the document navigation to avoid missing any essential areas in the template.

- Circle some of the important details and add a URL to it if needed.

- Use the Highlight or Line tools to emphasize the most important pieces of content.

- Choose colors and thickness for these lines to make your form look professional.

- Erase or blackout the details you don’t want to be visible to other people.

- Substitute pieces of content that contain mistakes and type in text that you need.

- Finish modifcations with the Done option when you make sure everything is correct in the document.

Our robust online solutions are the best way to complete and customize IRS W-4(SP) in accordance with your needs. Use it to prepare personal or professional documents from anywhere. Open it in a browser, make any changes in your documents, and return to them at any time in the future - they all will be securely kept in the cloud.

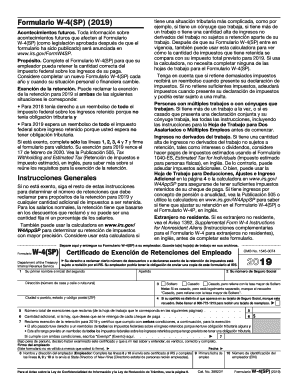

Filling out the IRS W-4(SP) for beginners can be straightforward with the right approach. Start by entering your personal information, including your name and social security number, and then follow the instructions for your filing status. Use the worksheets provided to determine your allowances and other relevant deductions. If you want a simple solution, consider using USLegalForms, which offers guidance and templates for completing tax forms effortlessly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.