Get Md Comptroller Mw506ae 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD Comptroller MW506AE online

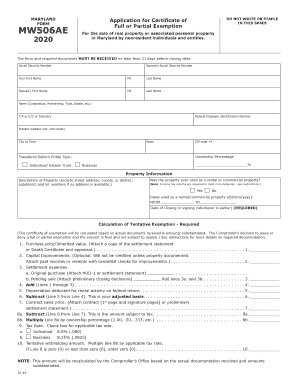

Filling out the MD Comptroller MW506AE form can seem daunting, but with clear instructions, it becomes manageable. This guide will provide step-by-step assistance on how to complete each section of the application for Certificate of Full or Partial Exemption for the sale of real property or associated personal property in Maryland.

Follow the steps to successfully complete the MW506AE form

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your personal information in the designated fields: Social Security Number, First Name, Middle Initial, Last Name, and your spouse's details if applicable. Ensure all fields are accurately completed.

- Indicate your entity type by checking the appropriate box: Individual, Estate, Trust, or Business.

- Provide the property information including a detailed description of the property and its address, ensuring you include county or district information if no street address exists.

- Check whether the property was ever used as a rental or commercial property and provide the dates of use, if applicable.

- Fill out the Calculation of Tentative Exemption section, starting with the purchase price or inherited value. Remember to attach the necessary documentation like a settlement statement or appraisal.

- Continue with lines calculating capital improvements, settlement expenses, adjusted basis, and contract sales price, ensuring each corresponds to the needed documentation.

- Select the applicable tax rate for your situation (Individual or Business) and calculate the tentative withholding amount based on the adjustments made.

- Complete the 'Special Situations' section if any conditions apply to your situation, and provide required documentation.

- Provide the address of the settlement agent where the certificate, if issued, should be mailed, along with your contact information.

- Review your application, sign and date where indicated, adding your preparer's information if the form was completed by someone else.

- Finally, submit your application to the Comptroller of Maryland, ensuring it is sent within the required 21 days before the closing date.

Complete your MW506AE form online today to ensure timely processing and compliance with Maryland regulations.

Get form

Filling out the MW507 withholding form involves entering your personal information, including your filing status and the number of exemptions you wish to claim. Start by carefully reading the instructions provided with the form to avoid errors. The MD Comptroller MW506AE offers resources to help you navigate the process effectively. If in doubt, consider using online services like uslegalforms for assistance.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.