Loading

Get Irs 1042-s 2019

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1042-S online

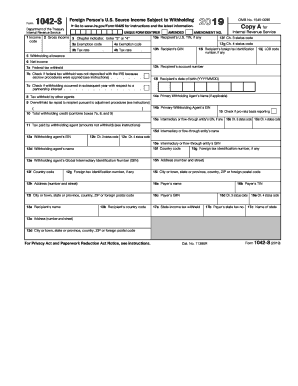

Filling out the IRS 1042-S form can be a straightforward process, especially when done online. This guide provides a comprehensive, step-by-step approach to assist users in completing the form accurately and efficiently.

Follow the steps to complete the IRS 1042-S online.

- Press the ‘Get Form’ button to access the form, which will allow you to open it in your online editor.

- Start with box 1 and select the relevant income code that describes the type of income being reported.

- In box 2, enter the gross amount of income that is subject to withholding.

- In box 3, indicate the chapter under which the income is taxed by entering ‘3’ or ‘4’.

- Complete boxes 3a and 4a with the appropriate exemption codes if applicable.

- In boxes 3b and 4b, specify the tax rates that apply to the income.

- Provide the recipient's U.S. TIN, if available, in box 13e.

- Fill in the recipient's foreign tax identification number in box 13i, if applicable.

- Indicate the federal tax withheld in box 7a, and if there are any special notes (like escrow procedures), mark box 7b.

- Review the information for accuracy, ensuring all necessary boxes are completed.

- After completing the form, you may choose to save your changes, download the completed form, print it, or share it as needed.

Complete your IRS 1042-S form online today for a hassle-free filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

IRS Form 1042-S is designed to report income earned by foreign individuals from U.S. sources. This includes interest, dividends, royalties, and various forms of compensation. The form helps both the payee and the IRS track income and withholding tax obligations. Using USLegalForms can simplify the process of understanding and filing this important tax document.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.