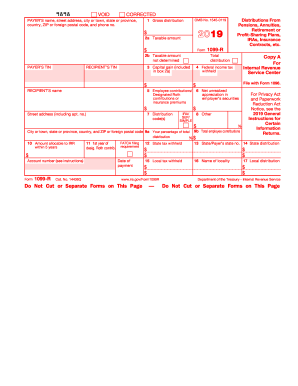

Get Irs 1099-r 2019

How It Works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Reportable online

How to fill out and sign Nua online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

If you aren?t associated with document managing and legal processes, filling out IRS docs will be quite nerve-racking. We comprehend the necessity of correctly completing documents. Our service offers the utility to make the procedure of filing IRS docs as elementary as possible. Follow this guideline to accurately and quickly complete IRS 1099-R.

How you can submit the IRS 1099-R on-line:

-

Click on the button Get Form to open it and start editing.

-

Fill in all required fields in the document utilizing our professional PDF editor. Switch the Wizard Tool on to finish the procedure even simpler.

-

Check the correctness of filled info.

-

Add the date of finishing IRS 1099-R. Utilize the Sign Tool to create your personal signature for the file legalization.

-

Finish editing by clicking Done.

-

Send this file directly to the IRS in the most convenient way for you: through email, making use of digital fax or postal service.

-

You have a possibility to print it on paper if a hard copy is required and download or save it to the favored cloud storage.

Using our service will make professional filling IRS 1099-R a reality. We will make everything for your comfortable and quick work.

How to edit Deferrals: customize forms online

Put the right document editing capabilities at your fingertips. Execute Deferrals with our trusted tool that comes with editing and eSignature functionality}.

If you want to execute and certify Deferrals online without hassle, then our online cloud-based solution is the ideal solution. We offer a wealthy template-based library of ready-to-use forms you can edit and fill out online. In addition, you don't need to print out the document or use third-party solutions to make it fillable. All the necessary tools will be readily available at your disposal as soon as you open the file in the editor.

Let’s go through our online editing capabilities and their main features. The editor features a self-explanatory interface, so it won't take a lot of time to learn how to utilize it. We’ll check out three main sections that let you:

- Edit and annotate the template

- Organize your paperwork

- Make them shareable

The top toolbar has the tools that help you highlight and blackout text, without graphics and graphic components (lines, arrows and checkmarks etc.), add your signature to, initialize, date the document, and more.

Use the toolbar on the left if you would like to re-order the document or/and remove pages.

If you want to make the template fillable for others and share it, you can use the tools on the right and insert different fillable fields, signature and date, text box, etc.).

Aside from the capabilities mentioned above, you can safeguard your file with a password, add a watermark, convert the document to the needed format, and much more.

Our editor makes modifying and certifying the Deferrals very simple. It enables you to make virtually everything concerning working with forms. Moreover, we always make sure that your experience working with files is secure and compliant with the main regulatory standards. All these factors make utilizing our tool even more pleasant.

Get Deferrals, apply the necessary edits and tweaks, and download it in the preferred file format. Give it a try today!

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Video instructions and help with filling out and completing allocable

In this video-guide, we share useful tips on how to complete the 1st fast and easy. Watch this video, fill in the template in minutes, and be ready to print it out or share it.

Irr FAQ

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Keywords relevant to IRS 1099-R

- form1099r

- OMB

- contrib

- desig

- allocable

- 1st

- irr

- 1040NR

- reportable

- 6050y

- recharacterized

- nua

- deferrals

- nontaxable

- youll

USLegal fulfills industry-leading security and compliance standards.

-

VeriSign secured

#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.

-

Accredited Business

Guarantees that a business meets BBB accreditation standards in the US and Canada.

-

TopTen Reviews

Highest customer reviews on one of the most highly-trusted product review platforms.