Loading

Get Ak Form 620 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AK Form 620 online

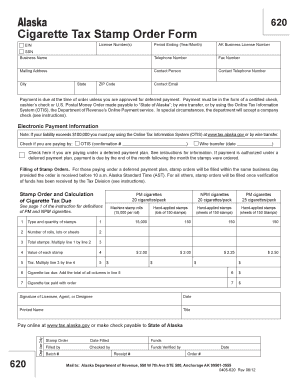

Filling out the AK Form 620 online is a straightforward process designed to facilitate the ordering of cigarette tax stamps in Alaska. This guide will provide you with step-by-step instructions to ensure a smooth completion of the form.

Follow the steps to successfully complete the AK Form 620 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Start by entering your license number(s) in the designated field. Ensure that all numbers are accurate to prevent delays in processing.

- Specify the period ending by entering the year and month in the appropriate section. This information is crucial for accurate record-keeping.

- Input your AK business license number, name, and telephone number. Make sure that the business name matches official records.

- Provide your mailing address including city, state, and ZIP code. Double-check this information for accuracy to ensure correct delivery.

- Enter the contact person's name, telephone number, and email address. This information will assist the department in case they need to reach out regarding your order.

- Detail your payment method. If under a deferred payment plan, indicate this by checking the specified box. Choose your payment option from the provided methods: OTIS confirmation number, wire transfer, or check.

- Fill out the stamp order and calculate the cigarette tax due by entering the type and quantity of stamps required. Follow the instructions on the form to complete the calculation.

- Sign the form by entering the signature of the licensee, agent, or designee along with the date of signing. Provide your printed name and title below the signature.

- Review all the information for accuracy and completeness. Once verified, you can save your changes, download the form, print it, or share it as needed.

Complete your AK Form 620 online today to ensure timely processing of your cigarette tax stamp order.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To calculate Louisiana franchise tax, start by determining your corporation's taxable capital, which includes assets minus liabilities. Once you have the taxable capital amount, apply the appropriate tax rates as outlined by the state. For easy navigation through forms and requirements, use uslegalforms, especially when dealing with AK Form 620.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.