Loading

Get Irs 1065 - Schedule D 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1065 - Schedule D online

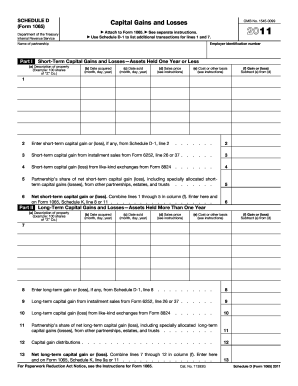

Filling out the IRS 1065 - Schedule D can be a straightforward process when you understand each component. This guide aims to provide clear instructions for accurately reporting capital gains and losses for your partnership.

Follow the steps to complete your Schedule D online.

- Click 'Get Form' button to access the IRS 1065 - Schedule D for completion.

- Begin by entering the employer identification number of the partnership at the top of the form. This is essential for proper identification.

- Next, fill in the name of the partnership as it appears on the tax documents.

- Proceed to Part I, focusing on short-term capital gains and losses. List the description of each property in column (a), followed by the date acquired in column (b) and the date sold in column (c).

- Enter the sales price in column (d) and the cost or other basis of the property in column (e). Calculate the gain or loss by subtracting the cost from the sales price in column (f).

- Complete lines 1 through 5 under this section, entering any short-term capital gains or losses from related forms as necessary.

- After completing Part I, move to Part II for long-term capital gains and losses. Repeat the same process as Part I, ensuring to accurately fill out each column.

- Combine the total capital gains or losses from both parts at the end of the sections and ensure that they are entered accurately for Form 1065, Schedule K.

- Once all fields are filled out, review your entries for accuracy and completeness.

- Finally, save your changes, download a copy for your records, print the completed form, or share it as needed.

Start completing your IRS 1065 - Schedule D online now to ensure timely and accurate tax filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

While it is technically possible to file IRS 1065 - Schedule D without Form 8949, it is not recommended. Form 8949 provides detailed information about each transaction, which is necessary for accurate reporting of capital gains and losses. Ensuring that both forms are correctly filled out helps maintain compliance and transparency with the IRS. Using platforms like uslegalforms can streamline this filing process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.