Loading

Get Md Mw506fr 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MD MW506FR online

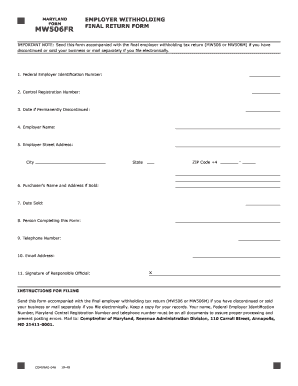

Filling out the MD MW506FR form is essential for employers who have discontinued or sold their business. This guide will provide you with clear and concise instructions on how to complete this form online to ensure accurate submission.

Follow the steps to complete the MD MW506FR form online.

- Press the ‘Get Form’ button to access the MD MW506FR form and open it in your editor.

- Begin by entering your Federal Employer Identification Number in the designated field. This unique number is essential for tax identification.

- Next, provide your Central Registration Number, which is required for businesses operating in Maryland.

- Indicate the date your business was permanently discontinued by entering it in the appropriate field.

- Fill in your Employer Name as registered with the state, ensuring accuracy for proper processing.

- Complete the Employer Street Address, followed by the City, State, and ZIP Code +4. This information is critical for communication from the state.

- If the business has been sold, provide the Purchaser’s Name and Address in the specified fields.

- Enter the Date Sold, if applicable, to ensure the state has an accurate record of the transaction.

- Insert the name of the Person Completing this Form, ensuring the individual is authorized to act on behalf of the business.

- Provide a Telephone Number where the state can reach you for any follow-up questions.

- Fill in your Email Address for additional communication regarding your submission.

- The final step is to have a responsible official sign the form, confirming the information is accurate and complete.

- Once all sections are filled out, you may save your changes, download a copy, print the form, or share it as needed.

Complete your MD MW506FR form online today for a smooth and accurate submission!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

When filling out the Maryland MW507, the number of exemptions you claim should reflect your personal tax situation. Use the guidelines provided in the form to help determine what is appropriate based on your income, dependents, and potential deductions. Accidentally over- or under-claiming can affect your tax outcome, so it's best to be mindful while considering your choices.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.