Get Wi Wt-4 2019-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WI WT-4 online

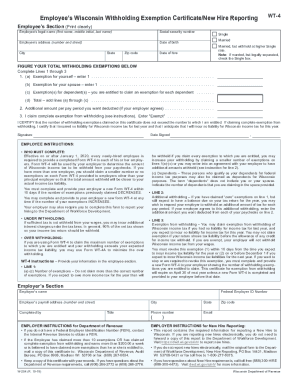

The WI WT-4 is an essential form for employees in Wisconsin, allowing them to declare their withholding exemptions to their employer. This guide will walk you through the process of completing the WI WT-4 online, ensuring that you provide the necessary information accurately and efficiently.

Follow the steps to complete the WI WT-4 online.

- Click 'Get Form' button to obtain the form and access it in your preferred editing tool.

- Fill in your personal details in the Employee's Section. You need to provide your legal name, social security number, address, date of birth, city, state, and zip code.

- Select your marital status by checking the appropriate box: Single, Married, or Married but withholding at a higher Single rate. If applicable, select the Single box if you are married but legally separated.

- Enter your date of hire to document when you began employment.

- Figure your total withholding exemptions by completing Lines 1 through 3: Line 1(a) for yourself, Line 1(b) for your spouse, Line 1(c) for dependents, and Line 1(d) for the total which is the sum of lines (a) through (c).

- For Line 2, if desired, specify any additional amount per pay period that you want deducted from your paycheck. Make sure your employer agrees to this additional withholding.

- If you want to claim complete exemption from withholding, enter 'Exempt' on Line 3, confirming that you had no tax liability for last year and anticipate none for this year.

- Review all entries for accuracy. Once completed, sign and date the form at the bottom.

- Submit the completed form to your employer. You may also opt to save changes, download, or print the form for your records.

Complete your WI WT-4 form online today to ensure accurate tax withholding on your paychecks.

Related links form

To complete the WI WT-4 form, start by inputting your personal information and selecting your filing status. Then determine the number of exemptions you're eligible to claim and enter this number accordingly. Lastly, ensure you sign and date the form, and submit it to your employer. Utilizing resources from US Legal Forms can provide you with templates and detailed steps for greater clarity in filling out the WT-4.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.