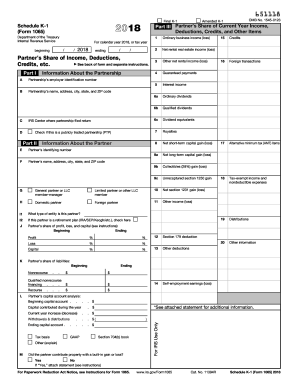

Get Irs 1065 - Schedule K-1 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1065 - Schedule K-1 online

How to fill out and sign IRS 1065 - Schedule K-1 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

If the tax season began unexpectedly or perhaps you merely overlooked it, it could likely cause issues for you. IRS 1065 - Schedule K-1 is not the simplest form, but you don’t have any reason to panic regardless.

By utilizing our premier service, you will discover the most effective method to complete IRS 1065 - Schedule K-1 even in circumstances of severe time constraints.

With this all-inclusive digital solution and its expert tools, submitting IRS 1065 - Schedule K-1 becomes easier. Don’t hesitate to try it and enjoy more time on hobbies instead of handling paperwork.

- Open the document with our state-of-the-art PDF editor.

- Input the necessary information in IRS 1065 - Schedule K-1, utilizing the fillable fields.

- Incorporate images, marks, checks, and text boxes, if applicable.

- Repeated fields will be populated automatically after the initial entry.

- If you encounter any issues, use the Wizard Tool. You will obtain guidance for simpler completion.

- Always remember to include the date of application.

- Create your unique signature once and position it in the required fields.

- Review the information you have entered. Amend errors if needed.

- Click Done to complete editing and decide how you will send it. You can use online fax, USPS, or email.

- Alternatively, you can download the document to print it later or upload it to cloud storage like Google Drive, OneDrive, etc.

How to modify Get IRS 1065 - Schedule K-1 2018: tailor forms online

Choose a trustworthy document editing service you can count on.

Alter, execute, and authenticate Get IRS 1065 - Schedule K-1 2018 securely online.

Frequently, handling paperwork, such as Get IRS 1065 - Schedule K-1 2018, can be cumbersome, particularly if you received them in a digital format without access to specialized applications.

Certainly, you can discover some alternatives to bypass it, but you might end up with a document that doesn't fulfill the submission standards. Using a printer and scanner isn’t a solution either because it’s time- and resource-intensive.

Forget about paper and other ineffective methods of processing your Get IRS 1065 - Schedule K-1 2018 or various documents. Utilize our tool instead, which merges one of the largest libraries of ready-to-edit templates with a robust file editing capability. It’s straightforward and secure, and can save you a significant amount of time! Don’t just take our word for it, give it a shot yourself!

- We provide a more efficient and organized method for altering files.

- A complete directory of document templates that are easy to modify and authenticate, making fillable for others.

- Our service goes far beyond a mere collection of templates.

- One of the primary advantages of utilizing our option is that you can edit Get IRS 1065 - Schedule K-1 2018 directly on our site.

- Since it’s a web-based solution, it frees you from needing any software.

- Moreover, not all corporate policies permit you to install it on your work computer.

- Here’s how you can effortlessly and securely execute your forms using our platform.

- Click the Get Form > you will be instantly redirected to our editor.

Related links form

To get a copy of your Schedule K-1, contact the partnership or S corporation that you are a part of. They are required to send you a copy for your records and tax filing. If you have trouble obtaining it, consider using resources like uslegalforms to find the necessary forms or templates.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.