Loading

Get Irs 1065 - Schedule M-3 2015

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1065 - Schedule M-3 online

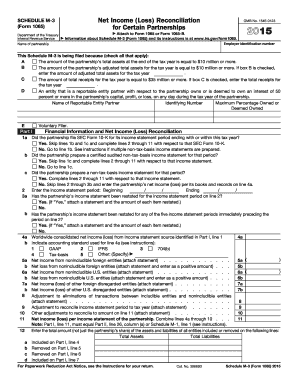

Filling out the IRS 1065 - Schedule M-3 online can simplify the process of reporting net income or loss for partnerships. This guide offers step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to fill out Schedule M-3 correctly.

- Press the ‘Get Form’ button to access the Schedule M-3 form and open it in your preferred online editor.

- Enter the employer identification number (EIN) and the name of the partnership at the top of the form.

- Indicate the reason for filing by checking the appropriate boxes based on the total assets, adjusted total assets, or total receipts of the partnership. Ensure that you enter any relevant amounts where prompted.

- In Part I, begin with questions regarding the financial information. Answer whether the partnership filed an SEC Form 10-K or a certified audited non-tax-basis income statement, and complete subsequent lines as directed.

- Complete each line under Part I that applies, providing amounts for worldwide consolidated net income or loss, net income from foreign and U.S. entities, and any necessary adjustments.

- Continue to Part II, reconciling net income or loss from the partnership's income statement with the tax return. Populate temporary and permanent differences as required.

- In Part III, detail expense and deduction items, indicating the corresponding temporary and permanent differences for each line.

- Review all fields for accuracy and completeness. Make sure that totals in Part II match the corresponding lines in Part I and the form overall.

- After ensuring all information is correct, follow the options available to save your changes, download, print, or share the completed form.

Complete your forms online to streamline your tax filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Schedule M-3 was introduced in 2005 as a part of a broader initiative to enhance tax compliance for large partnerships and corporations. It aimed to simplify the IRS’s ability to analyze tax returns and required more detailed information. As a result, those dealing with IRS 1065 - Schedule M-3 should stay updated with any changes or revisions in the filing process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.