Get Pa Dced Clgs-32-1 2016-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

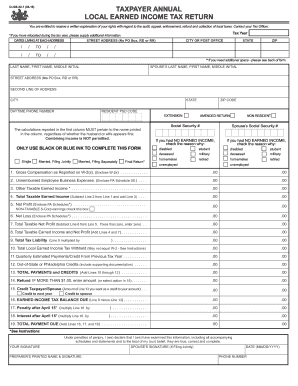

Tips on how to fill out, edit and sign PA DCED CLGS-32-1 online

How to fill out and sign PA DCED CLGS-32-1 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Tax blank filling out can become a serious problem and serious headache if no correct assistance supplied. US Legal Forms is developed as an web-based resolution for PA DCED CLGS-32-1 e-filing and offers numerous benefits for the taxpayers.

Use the guidelines on how to fill in the PA DCED CLGS-32-1:

-

Find the blank on the site in the particular section or via the Search engine.

-

Click on the orange button to open it and wait until it?s loaded.

-

Go through the blank and pay attention to the guidelines. If you have never completed the template before, adhere to the line-to-line recommendations.

-

Concentrate on the yellow fields. These are fillable and need certain information to be placed. If you are unclear what info to put in, see the recommendations.

-

Always sign the PA DCED CLGS-32-1. Use the built-in instrument to make the e-signature.

-

Click the date field to automatically insert the appropriate date.

-

Re-read the sample to press and change it before the submission.

- Hit the Done button in the upper menu if you have finished it.

-

Save, download or export the completed template.

Utilize US Legal Forms to make sure secure as well as simple PA DCED CLGS-32-1 filling out

How to edit PA DCED CLGS-32-1: customize forms online

Facilitate your document preparation process and adjust it to your demands within clicks. Fill out and sign PA DCED CLGS-32-1 using a robust yet user-friendly online editor.

Preparing documents is always troublesome, especially when you deal with it occasionally. It demands you strictly follow all the formalities and accurately complete all fields with full and accurate information. However, it often occurs that you need to adjust the form or add more fields to fill out. If you need to improve PA DCED CLGS-32-1 prior to submitting it, the best way to do it is by using our comprehensive yet easy-to-use online editing tools.

This extensive PDF editing solution enables you to easily and quickly complete legal paperwork from any internet-connected device, make fundamental edits to the form, and add more fillable fields. The service enables you to choose a particular area for each data type, like Name, Signature, Currency and SSN and so on. You can make them required or conditional and choose who should complete each field by assigning them to a particular recipient.

Make the steps listed below to improve your PA DCED CLGS-32-1 online:

- Open needed sample from the catalog.

- Fill out the blanks with Text and drop Check and Cross tools to the tickboxes.

- Use the right-hand panel to adjust the template with new fillable areas.

- Select the fields based on the type of data you want to be collected.

- Make these fields required, optional, and conditional and customize their order.

- Assign each area to a particular party with the Add Signer option.

- Verify that you’ve made all the required adjustments and click Done.

Our editor is a universal multi-featured online solution that can help you easily and quickly optimize PA DCED CLGS-32-1 along with other templates according to your requirements. Optimize document preparation and submission time and make your paperwork look professional without hassle.

Related links form

Forgetting to file local taxes in Pennsylvania can result in penalties and interest on any unpaid tax balance. It is essential to file your tax return regardless of the delay. Look into the PA DCED CLGS-32-1 for further guidance on corrective actions. For assistance in completing your filings, uslegalforms offers valuable tools to support you.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.