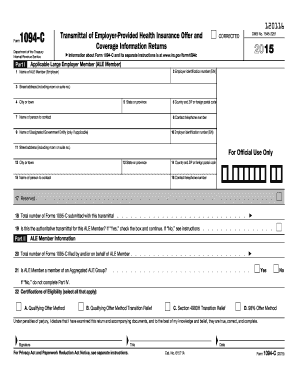

Get Irs 1094-c 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Certifications online

How to fill out and sign NOV online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

If the tax period began unexpectedly or you simply missed it, it could likely cause issues for you. The IRS 1094-C is not the simplest form, but there is no need for concern in any situation.

By using our expert service, you will learn how to complete the IRS 1094-C even in times of significant time constraints. Just adhere to these simple instructions:

With our robust digital solution and its helpful features, completing the IRS 1094-C becomes simpler. Don’t hesitate to try it out and allocate more time to personal interests instead of document preparation.

Access the document in our state-of-the-art PDF editor.

Enter all the necessary details in IRS 1094-C, utilizing fillable fields.

Include images, symbols, checkboxes, and text boxes, if necessary.

Repeating information will automatically populate after the initial entry.

If you encounter any issues, activate the Wizard Tool. You will receive some tips for smoother submission.

Remember to include the filing date.

Create your personal e-signature once and place it in all required locations.

Review the information you have entered. Amending errors if necessary.

Select Done to complete editing and decide how you will transmit it. You will have the option to use digital fax, USPS, or email.

You can download the document to print later or save it to cloud storage such as Google Drive, Dropbox, etc.

How to modify Get IRS 1094-C 2015: personalize forms online

Forget the conventional paper method of finalizing Get IRS 1094-C 2015. Have the document completed and validated in moments with our expert online editor.

Are you compelled to adjust and finalize Get IRS 1094-C 2015? With an expert editor like ours, you can accomplish this task in just minutes without the necessity to print and scan documents repeatedly. We offer fully editable and user-friendly document templates that will kickstart your process and help you complete the necessary form online.

All files, automatically, include fillable fields you can act upon as soon as you access the template. However, if you wish to refine the existing content of the form or introduce new information, you can select from a range of customization and annotation tools. Emphasize, obscure, and comment on the document; insert checkmarks, lines, text boxes, graphics, notes, and remarks. Furthermore, you can conveniently validate the template with a legally-binding signature. The finalized form can be shared with others, saved, imported into external applications, or converted into various other formats.

You’ll never make a mistake by opting for our online tool to manage Get IRS 1094-C 2015 because it's:

Don't waste time finalizing your Get IRS 1094-C 2015 in an outdated manner - with pen and paper. Opt for our feature-rich tool instead. It offers you a versatile array of editing tools, integrated eSignature functionalities, and user-friendliness. What distinguishes it from comparable alternatives is the team collaboration capabilities - you can collaborate on documents with anyone, create a streamlined document approval process from scratch, and much more. Explore our online tool and receive the best value for your investment!

- Simple to set up and use, even for individuals who haven't filled out paperwork digitally before.

- Strong enough to accommodate diverse modifying requirements and document types.

- Safe and secure, ensuring your editing experience is protected every time.

- Accessible across various operating systems, making it simple to complete the document from anywhere.

- Able to generate forms based on pre-designed templates.

- Compatible with numerous document formats: PDF, DOC, DOCX, PPT, JPEG, etc.

Related links form

The employer, specifically the designated individual responsible for compliance, typically fills out the 1094-C. This individual should ensure that all relevant information about the employer and employee health coverage is accurately reported. Effective completion of the 1094-C requires careful attention to detail to comply with IRS regulations. USLegalForms can provide guidance and resources to make this task easier.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.