Loading

Get Ak Form 625 2012-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AK Form 625 online

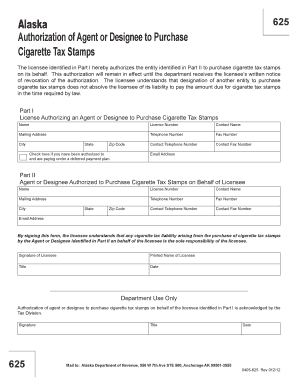

Filling out the AK Form 625 online is a straightforward process that allows licensees to authorize an agent or designee for purchasing cigarette tax stamps. This guide will walk you through each component of the form to ensure a seamless experience.

Follow the steps to complete the AK Form 625 online

- Click the ‘Get Form’ button to access the form and open it in your browser.

- In Part I, provide the necessary information of the licensee. Fill in the name, license number, and contact name. Ensure the mailing address, telephone number, and fax number are accurately entered. Include the city, state, and zip code. If applicable, check the box indicating authorization under a deferred payment plan. Lastly, enter the email address.

- Move to Part II and enter the details of the agent or designee authorized to purchase cigarette tax stamps. Input their name, license number, and contact name. Complete the mailing address, telephone number, and fax number fields. Include the city, state, zip code, and email address for the agent or designee.

- Read the statement regarding liability and responsibilities to ensure understanding. Provide the signature of the licensee, followed by the printed name, title, and date of signing. This is a crucial step to confirm the authorization.

- Once all fields have been filled out, review the form for accuracy. You can then save the changes made, download the completed form, print it for records, or share it electronically as needed.

Complete the AK Form 625 online to ensure compliance and facilitate the purchase of cigarette tax stamps.

Related links form

1 tax form is provided by partnerships, Scorporations, estates, and trusts that pass income through to their partners, shareholders, or beneficiaries. These entities are responsible for preparing and distributing K1 forms to the relevant recipients. To ensure you receive your K1 form on time, maintain open communication with the entity involved.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.