Loading

Get Ny Ct-3-a 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY CT-3-A online

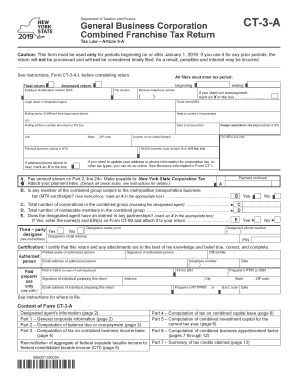

Filling out the NY CT-3-A form online can streamline your tax return process for general business corporations in New York. This guide will help you understand each section of the form and provide step-by-step instructions to ensure you complete it accurately.

Follow the steps to complete your NY CT-3-A online.

- Click ‘Get Form’ button to access the NY CT-3-A online document and open it in your preferred editor.

- Enter the tax period you are filing for. You must include both the beginning and ending dates of your tax period.

- Provide your employer identification number (EIN) and file number, along with your business telephone number.

- Indicate whether you are filing a final or amended return by marking the corresponding box.

- Complete the designated agent's information, including their legal name, trade name, and mailing address.

- Fill in the state or country of incorporation and the principal business activity in New York State.

- If there were any updates to your address or phone number, mark the appropriate box.

- Proceed to Part 2, where you will compute the balance due or overpayment. Follow the prompts to enter the required financial data.

- Continue through the subsequent parts of the form, completing each computation and section as specified.

- After you have filled in all necessary fields, you can save changes, download, print, or share the form as needed.

Complete your NY CT-3-A form online today for an efficient tax management experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The NY MTA surcharge applies to corporations based in the Metropolitan Transportation Authority district. If your business generates significant revenue and is based in this area, you will need to account for this surcharge on your NY CT-3-A. Assessing your location and revenue can help you understand your tax responsibilities better.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.