Loading

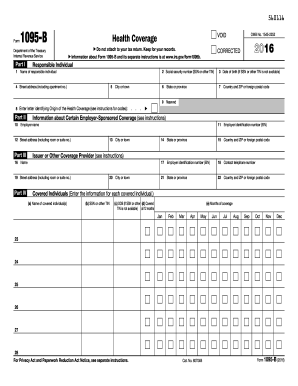

Get Irs 1095-b 2016

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1095-B online

The IRS 1095-B form provides crucial information about your health coverage and is essential for tax reporting. This guide will walk you through the process of filling out the form online, ensuring a smooth and accurate submission.

Follow the steps to complete the IRS 1095-B form online.

- Click ‘Get Form’ button to access the form and open it in the online editor.

- In Part I, enter the responsible individual's information. This includes the name and social security number (SSN or other taxpayer identification number) in lines 2 and 3. If the SSN is not available, input the date of birth instead.

- For line 8, enter the letter code that corresponds to the origin of the health coverage. The options include codes for various coverage types, such as Employer-sponsored coverage (B) or Government-sponsored programs (C).

- In Part II, provide details about employer-sponsored coverage if applicable. Fill in lines 10 to 15 with the employer's information, including the employer identification number (EIN), if available.

- Move to Part III, where you will enter the issuer or other coverage provider's information. Fill lines 16 to 22, including their address and contact telephone number for inquiries.

- In Part IV, list all covered individuals. For each person, complete the name, SSN or other TIN, and date of birth if available. Indicate for which months they were covered by checking the appropriate boxes for each month.

- If there are more than six covered individuals, use the continuation sheets provided to include additional entries.

- Once all sections are filled out accurately, save your changes, then proceed to download, print, or share the completed form as needed.

Complete your IRS 1095-B form online today for hassle-free tax reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

One significant benefit of the IRS 1095-B is that it provides proof of your health coverage for the tax year. This form can protect you from potential penalties related to health insurance requirements, giving you peace of mind during tax season.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.