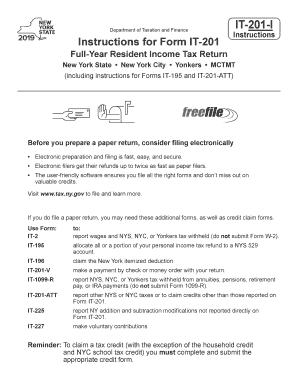

Get Ny It-201-i 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NY IT-201-I online

How to fill out and sign NY IT-201-I online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Nowadays, most Americans would rather do their own taxes and, furthermore, to fill out forms digitally. The US Legal Forms online platform makes the procedure of e-filing the NY IT-201-I easy and convenient. Now it takes no more than thirty minutes, and you can accomplish it from any place.

Tips on how to get NY IT-201-I quick and easy:

-

Access the PDF template in the editor.

-

Refer to the highlighted fillable lines. This is where to put in your details.

-

Click on the option to choose if you see the checkboxes.

-

Check out the Text icon along with other powerful features to manually change the NY IT-201-I.

-

Verify all the details before you keep signing.

-

Create your exclusive eSignature by using a key-board, camera, touchpad, computer mouse or cell phone.

-

Certify your PDF form online and place the particular date.

-

Click Done proceed.

-

Download or send the document to the recipient.

Be sure that you have completed and sent the NY IT-201-I correctly in time. Take into account any applicable term. When you provide false data with your fiscal papers, it may result in significant fees and create problems with your yearly tax return. Be sure to use only qualified templates with US Legal Forms!

How to edit NY IT-201-I: customize forms online

Have your stressless and paper-free way of modifying NY IT-201-I. Use our reliable online option and save a great deal of time.

Drafting every form, including NY IT-201-I, from scratch requires too much effort, so having a tried-and-tested solution of pre-uploaded form templates can do magic for your productivity.

But modifying them can be challenge, especially when it comes to the files in PDF format. Luckily, our huge library features a built-in editor that allows you to easily complete and edit NY IT-201-I without leaving our website so that you don't need to lose your precious executing your paperwork. Here's what you can do with your document utilizing our solution:

- Step 1. Locate the required form on our website.

- Step 2. Click Get Form to open it in the editor.

- Step 3. Use our professional editing features that allow you to insert, remove, annotate and highlight or blackout text.

- Step 4. Generate and add a legally-binding signature to your document by using the sign option from the top toolbar.

- Step 5. If the document layout doesn’t look the way you want it, use the features on the right to erase, add more, and arrange pages.

- step 6. Add fillable fields so other persons can be invited to complete the document (if applicable).

- Step 7. Share or send the form, print it out, or select the format in which you’d like to download the file.

Whether you need to complete editable NY IT-201-I or any other document available in our catalog, you’re on the right track with our online document editor. It's easy and safe and doesn’t require you to have particular tech background. Our web-based solution is set up to deal with virtually everything you can imagine when it comes to document editing and execution.

Forget about the outdated way of working with your forms. Go with a more efficient solution to help you simplify your activities and make them less reliant on paper.

To qualify for the school tax credit, ensure that you meet the residency, income, and dependent criteria required by New York City. It's essential to file your tax returns, including form NY IT-201-I, to demonstrate your eligibility and properly claim any available credits. Keeping accurate records of your expenses will also help streamline this process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.