Loading

Get Ak Form 6321 2015-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AK Form 6321 online

This guide provides clear and supportive instructions on completing the AK Form 6321 online. Follow the steps outlined below to ensure accurate and efficient submission of your form.

Follow the steps to complete the AK Form 6321 accurately.

- Click 'Get Form' button to download the form and open it in your preferred editing tool.

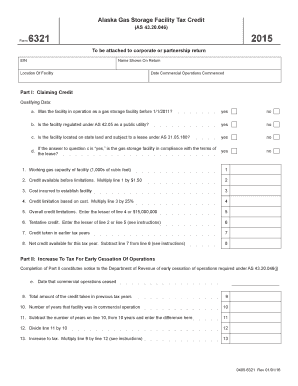

- Input your Employer Identification Number (EIN) in the designated field at the top of the form.

- Enter the name as shown on your corporate or partnership return in the appropriate section.

- Fill in the location of your gas storage facility, ensuring all relevant details are included.

- Specify the date when commercial operations commenced using the designated date field.

- In Part I, begin claiming your credit. Answer each qualifying question (a to c) by selecting 'yes' or 'no'. Pay close attention to the requirements for compliance, especially for question c.

- Complete Section d by inputting the working gas capacity of your facility in line 1.

- Calculate the credit available before limitations by multiplying line 1 by $1.50 and enter your result on line 2.

- Input any costs incurred to establish your facility on line 3.

- To determine the credit limitation based on cost, multiply the amount entered on line 3 by 25% and write the result on line 4.

- Enter the lesser amount of line 4 or $15,000,000 on line 5 for your overall credit limitations.

- Calculate the tentative credit by entering the lesser of line 2 or line 5 on line 6.

- List any credit taken in earlier tax years on line 7.

- Calculate the net credit available for the current tax year by subtracting line 7 from line 6; write this amount on line 8.

- Move to Part II if applicable and fill in the date that commercial operations ceased on line 9.

- Indicate the number of years the facility was in commercial operation on line 10.

- Subtract the number of years on line 10 from 10 years, writing the difference on line 11.

- Divide the amount on line 11 by 10 and write the result on line 12.

- Finally, calculate the increase to tax by multiplying the amount from line 9 by the result on line 12 and document this on line 13.

- Once all sections are complete, save your changes, and download, print, or share your form as necessary.

Complete your AK Form 6321 online today to ensure proper submission and tax credit processing.

Related links form

Filling out an employee's withholding certificate involves entering your personal details, such as your name and identification number, and choosing the correct number of allowances. Take your time to review each section of the AK Form 6321, as this determines how much federal tax will be deducted from each paycheck. Accurate completion leads to effective financial planning and fewer surprises during tax season.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.