Loading

Get Ok Otc 921 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OK OTC 921 online

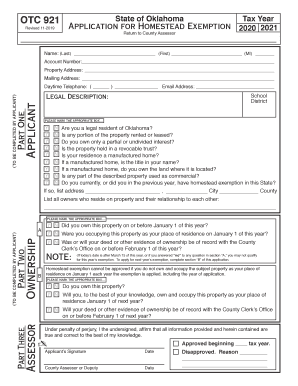

The OK OTC 921 is an application for homestead exemption in the State of Oklahoma. This guide provides comprehensive instructions for filling out the form online, ensuring that users can complete their application accurately and efficiently.

Follow the steps to fill out the OK OTC 921 online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your personal information in the designated fields. This includes your name (last, first, and middle initial), account number, property address, and mailing address.

- Complete the 'Daytime Telephone' and 'Email Address' fields to ensure the county assessor can reach you regarding your application.

- In Part One, mark the appropriate box for each question regarding your residency status, ownership details, and property usage. This information will determine your eligibility for the homestead exemption.

- List all owners who reside on the property and their relationships to each other to provide clarity on ownership.

- Proceed to Part Two and again mark the appropriate boxes regarding your residency occupancy and the status of your ownership documentation.

- In the final section, affirm the truthfulness of the information provided by signing and dating the application.

- Once you have filled out and reviewed the form for accuracy, save your changes, and choose to download, print, or share the form as needed for submission.

Start your application process today by completing the OK OTC 921 online.

Related links form

Your homestead application may have been denied for various reasons, including exceeding income limits, not properly occupying the property, or failing to provide necessary documentation. It's essential to review the specific denial letter from your local tax authority to understand the reasons clearly. If needed, the OK OTC 921 platform can guide you on how to correct any issues for future applications.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.