Loading

Get Il Dor Il-1040 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL DoR IL-1040 online

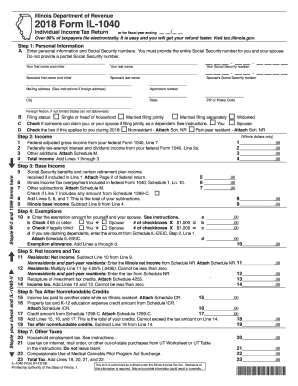

Filing your individual income tax return online using the IL DoR IL-1040 can be a straightforward process. This guide aims to support you through each section and field of the form with clear and detailed instructions.

Follow the steps to successfully complete your IL-1040 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your personal information in Step 1. This includes your name, Social Security number, and mailing address. Ensure to provide complete Social Security numbers for both yourself and your spouse if applicable. Indicate your filing status by selecting one of the provided options.

- For Step 2, focus on your income. Begin with your federal adjusted gross income as reported on your federal Form 1040. Additionally, report any federally tax-exempt interest and other additions that apply to you by following the prompts.

- In Step 3, calculate your base income. Subtract any allowed subtractions from your total income. According to the instructions, this includes specific retirement incomes and Illinois Income Tax overpayments.

- Proceed to Step 4 to enter your exemptions. Assess whether you are eligible for exemptions for yourself, your spouse, or any dependents, and input the corresponding amounts.

- In Step 5, calculate your net income and corresponding tax. Ensure you multiply your net income by the applicable tax rate as instructed.

- For Step 6, keep track of any tax credits that may apply to you. Input any amounts for credits that can reduce your tax liability.

- Next, complete Step 7 which accounts for any other taxes owed such as household employment tax or use tax for out-of-state purchases.

- Move to Step 8 to report payments and refundable credits. Sum all applicable payments from various sources.

- In Step 9, if you have payments greater than total tax owed, calculate your potential refund by subtracting the total tax from your payments. Conversely, if total tax is higher, denote the amount owed.

- Finalize your return by completing any signature fields required in Step 13, specifically if you are filing jointly. Ensure to accurately fill out your and your spouse's signature, along with identification information.

- Once all steps are completed, you can save your changes, download, print, or share the form as needed.

Start your online filing today to ensure timely submission and faster refunds.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Certain individuals may be exempt from filing the IL DoR IL-1040, such as those whose income is below the established threshold, or individuals who do not have Illinois-sourced income. However, it’s crucial to confirm your exemption status based on current tax laws. Consulting a tax professional can provide clarity if you're unsure about your filing requirements.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.