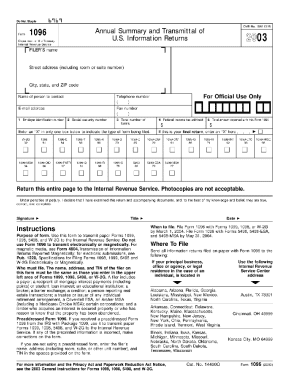

Get Irs 1096 2003

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1096 online

How to fill out and sign IRS 1096 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

When the tax term commenced unexpectedly or perhaps you just overlooked it, it could potentially lead to issues for you. IRS 1096 is not the simplest one, but you have no cause for concern in any situation.

Utilizing our expert online software, you will comprehend the correct method to complete IRS 1096 in circumstances of critical time shortage. The only requirement is to adhere to these uncomplicated instructions:

With our robust digital solution and its valuable tools, completing IRS 1096 becomes more convenient. Don’t hesitate to try it and spend more time on hobbies instead of document preparation.

Access the document in our advanced PDF editor.

Complete the required information in IRS 1096, utilizing fillable fields.

Add images, crosses, checks, and text boxes, as needed.

Repetitive information will be automatically populated after the initial input.

In case of confusion, utilize the Wizard Tool. You will receive some guidance for easier submission.

Always remember to include the application date.

Create your distinct signature once and place it in all the necessary lines.

Review the information you have entered. Rectify errors if necessary.

Hit Done to finish editing and select how you will send it. You will find options to use online fax, USPS, or electronic mail.

You can download the file for printing later or upload it to cloud storage like Dropbox, OneDrive, etc.

How to modify Get IRS 1096 2003: tailor forms online

Streamline your document preparation workflow and adjust it to your specifications with just a few clicks. Complete and authorize Get IRS 1096 2003 using a powerful yet user-friendly online editor.

Handling documents is frequently challenging, particularly when you manage it infrequently. It requires you to strictly follow all the necessary protocols and correctly fill in all sections with complete and accurate information. However, it often occurs that you need to alter the document or incorporate additional fields to complete. If you wish to refine Get IRS 1096 2003 before submission, the optimal way to do it is by utilizing our robust yet straightforward online editing tools.

This comprehensive PDF editing solution enables you to swiftly and effortlessly finalize legal documents from any internet-enabled device, perform simple modifications to the form, and add extra fillable sections. The service provides you the choice of a specific area for each data type, such as Name, Signature, Currency, and SSN, etc. You can designate them as mandatory or conditional and determine who should complete each section by assigning them to a specific recipient.

Our editor is a versatile, feature-rich online solution that can assist you in swiftly and seamlessly enhancing Get IRS 1096 2003 and other templates according to your requirements. Decrease document preparation and submission time while ensuring your paperwork appears professional without any hassle.

- Access the required document from the directory.

- Fill in the blanks with Text and utilize Check and Cross tools for the tick boxes.

- Use the toolbar on the right to modify the form with new fillable sections.

- Select the fields based on the type of information you wish to gather.

- Designate these fields as required, optional, or conditional and adjust their order.

- Assign each field to a specific individual using the Add Signer tool.

- Review if you’ve made all the necessary modifications and click Done.

Related links form

Generally, you can file one IRS 1096 form for all 1099 forms that you are submitting, provided they are the same type. However, if you have different types of 1099s, you will need to submit a separate 1096 for each type. This may seem tedious, but it helps keep your tax filings organized and compliant.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.