Loading

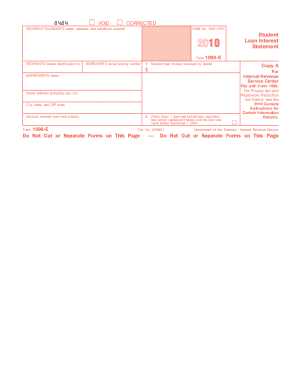

Get Irs 1098-e 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1098-E online

Filling out the IRS 1098-E form is an essential step for individuals looking to report student loan interest for tax purposes. This guide provides clear and detailed instructions to help users complete the form online with ease.

Follow the steps to fill out the IRS 1098-E online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the recipient’s or lender’s name, address, and telephone number in the designated fields.

- Provide the recipient’s federal identification number, which is essential for correct filing.

- In the box labeled for the borrower’s social security number, enter the correct SSN of the borrower.

- In Box 1, state the total amount of student loan interest received by the lender during the year.

- In Box 2, check the box if the amount in Box 1 does not include loan origination fees or capitalized interest for loans made before September 1, 2004.

- Fill in the street address, city, state, and ZIP code of the borrower.

- Include the borrower’s name and account number as needed.

- Review all entries to ensure accuracy before saving changes.

- Finally, download, print, or share the completed form as necessary.

Complete your IRS 1098-E online today to ensure your student loan interest is accurately reported.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You do not need to submit the IRS 1098-E with your tax return, but you should keep it for your records. The IRS uses the information on the form to verify your claims. When you file, you will enter the information from the form on your tax return. This step is crucial to claim any deductions correctly.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.