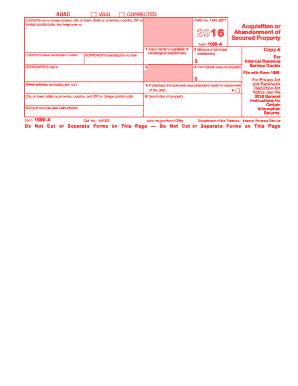

Get Irs 1099-a 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1099-A online

Filling out the IRS 1099-A form online is a critical task for individuals and businesses reporting the acquisition or abandonment of secured property. This guide provides step-by-step instructions to help you navigate each section of the form with clarity and accuracy.

Follow the steps to complete the IRS 1099-A form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the lender's name and address. This includes the street address, city or town, state or province, country, ZIP code, and telephone number.

- Input the lender's federal identification number in the designated field.

- Provide the borrower's identification number, which may display only the last four digits of the social security number or taxpayer identification number for privacy.

- Fill in the date of lender's acquisition or knowledge of abandonment. This is generally the date title was transferred.

- Enter the balance of principal outstanding on the loan when the lender acquired the property.

- Document the fair market value of the property at the time of acquisition or knowledge of abandonment.

- Indicate if the borrower was personally liable for repayment of the debt by checking the appropriate box.

- Provide a description of the property acquired or abandoned.

- After completing all sections, you can save changes, download, print, or share the form as needed.

Complete the IRS 1099-A form online today to ensure accurate reporting.

Get form

Related links form

To fill out the IRS 1099-A form step by step, first gather the necessary information such as borrower and lender names, property details, and amounts owed. Next, enter the data into the correct sections of the form, making sure to double-check for accuracy. After filling it out, ensure you submit it both to the IRS and provide a copy to the borrower. If you wish for a guided process, the resources available on USLegalForms can assist you in navigating this form with ease.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.