Loading

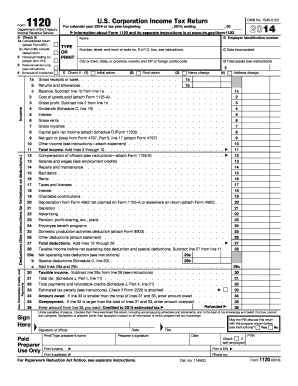

Get Irs 1120 2014

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1120 online

Filling out the IRS 1120 form can seem daunting, but with the right guidance, it becomes manageable. This guide is designed to help users navigate the process of completing the U.S. Corporation Income Tax Return online effectively.

Follow the steps to complete your IRS 1120 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill out the corporation's name and employer identification number in the appropriate fields. Ensure that the name matches the IRS records to avoid processing delays.

- Indicate the date of incorporation and fill in the corporation’s address, including city, state, and ZIP code.

- In Section E, check the boxes that apply, such as whether this is an initial return, final return, or if there has been a name or address change.

- Proceed to report your total income by listing gross receipts and other forms of income earned during the tax year. This includes dividing gross receipts from sales and any income generated through investments.

- Document all deductions including compensation of officers, salaries, and any other operational expenses accurately. Attach necessary schedules if additional information is required.

- After entering all relevant income and deductions, calculate the taxable income by following the instructions provided on the form.

- In the tax computation section, calculate the total taxes owed based on your taxable income, considering any applicable credits.

- Complete Schedules C and J as needed based on your specific income and deduction classifications, ensuring all calculations are accurate.

- Once you have finished filling out the form and all necessary schedules, please review for accuracy and completeness.

- Save your changes, and download the completed form for your records. You may also choose to print it or share it directly as required.

Start filling out your IRS 1120 form online today to ensure timely and accurate tax filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Yes, you can file IRS 1120 online using various tax preparation software approved by the IRS. Filing online is often more efficient and offers faster processing times. Platforms like US Legal Forms can help you navigate the online filing process and ensure compliance with all requirements.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.