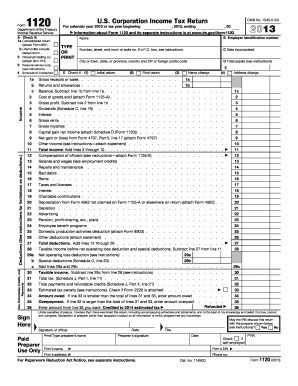

Get Irs 1120 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1120 online

How to fill out and sign IRS 1120 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

When individuals aren’t engaged with document management and legal processes, filling out IRS forms can be remarkably stressful.

We completely understand the importance of accurately completing forms.

You have the option to print it out on paper when a copy is needed and download or save it to your preferred cloud storage. Utilizing our ultimate solution can definitely facilitate professional completion of IRS 1120. Make everything for your ease and simple operation.

- Select the button 'Get Form' to open it and begin editing.

- Complete all necessary fields in the chosen document utilizing our robust and user-friendly PDF editor. Activate the Wizard Tool to make the process even easier.

- Verify the accuracy of the entered information.

- Include the date for filing IRS 1120. Use the Sign Tool to create a unique signature for the document authentication.

- Finish editing by clicking 'Done'.

- Submit this document directly to the IRS in the most convenient manner for you: via email, using digital fax, or postal service.

How to modify Get IRS 1120 2013: personalize documents online

Experience a stress-free and digital method of operation with Get IRS 1120 2013. Utilize our reliable online solution and conserve significant amounts of time.

Creating each document, including Get IRS 1120 2013, from the ground up consumes excessive time, thus having a proven approach with pre-prepared document templates can greatly enhance your efficiency.

However, interacting with them can be challenging, particularly with files in PDF format. Thankfully, our wide-ranging library includes a built-in editor that enables you to effortlessly complete and modify Get IRS 1120 2013 without leaving our site, preventing you from spending hours filling out your forms. Here’s what you can accomplish with your document using our service:

Whether you need to manage editable Get IRS 1120 2013 or any other document listed in our library, you’re on the right track with our online document editor. It's simple and safe, requiring no advanced technical skills. Our web-based solution is crafted to handle nearly everything you can think of regarding document modification and completion.

Forget conventional methods of managing your forms. Choose a more effective solution that assists you in optimizing your tasks and making them less reliant on paper.

- Step 1. Locate the required document on our site.

- Step 2. Hit Get Form to launch it in the editor.

- Step 3. Utilize specialized editing capabilities that permit you to insert, delete, annotate, and highlight or obscure text.

- Step 4. Generate and attach a legally-valid signature to your document by using the signing option from the top toolbar.

- Step 5. If the document format doesn’t appear as desired, use the features on the right to eliminate, add, and organize pages.

- Step 6. Incorporate fillable fields so others can be invited to complete the document (if relevant).

- Step 7. Distribute or send the document, print it, or select the format in which you want to download the document.

Related links form

Even if your business has no income, you usually must file a tax return. Filing helps you maintain proper records and stay compliant with IRS rules. It also gives you a chance to claim any potential deductions or credits you may qualify for. Using Form 1120 will clarify your status and process, and uslegalforms can help simplify the filing.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.