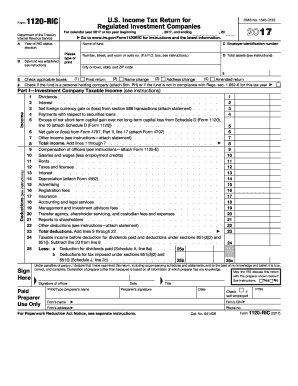

Get Irs 1120-ric 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1120-RIC online

This guide provides clear and concise instructions on how to fill out the IRS 1120-RIC form online. The IRS 1120-RIC form is essential for regulated investment companies to report their income, deductions, and taxes. Following these steps will help ensure the process is straightforward and accurate.

Follow the steps to successfully complete your IRS 1120-RIC online.

- Click ‘Get Form’ button to access the IRS 1120-RIC form and open it in your online editor.

- Enter the date the fund was established in the designated field. Ensure that the format meets IRS standards for dates to avoid processing issues.

- Complete the section indicating the year of RIC status election to clarify which tax year the form pertains to.

- Fill in the name of the fund as well as the employer identification number in the specified fields. Ensure that this information matches official documentation to prevent discrepancies.

- Detail the total assets of the fund, as this information is crucial for calculating tax obligations. Refer to the instructions for guidance on how to determine this total.

- Check all applicable boxes under section F regarding the nature of the return to confirm if it is a final return, an amended return, or if there is a name or address change.

- Proceed to Part I and begin entering income figures for each source listed, such as dividends and interest. Be sure to attach relevant statements where indicated.

- Next, record the deductions in the appropriate section, ensuring you attach Form 1125-E if necessary to support entries related to officer compensation.

- Calculate taxable income before accounting for dividends paid and input this figure as directed in the instructions. Accurate calculations are essential at this stage.

- Continue completing the form by entering the deductions for dividends paid, using Schedule A for clarity and adherence to IRS guidelines.

- Input necessary information for taxes owed or overpayments in the tax and payments section, which helps determine any credits or refunds.

- Finally, review all entries for accuracy, sign the form, and prepare to submit or save it according to your needs. Options typically include saving changes, downloading, or printing the completed form.

Start filling out your IRS 1120-RIC online today to ensure timely and accurate submission.

Get form

Related links form

RIC ownership requirements focus on shareholder qualifications and distribution needs. To qualify, a RIC must have at least 100 shareholders and meet asset diversification standards. Additionally, RICs should distribute significant income to maintain favorable tax treatment. Understanding these requirements is crucial, and platforms like US Legal Forms can assist in navigating this complex landscape.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.