Get Irs 1120s - Schedule M-3 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1120S - Schedule M-3 online

How to fill out and sign IRS 1120S - Schedule M-3 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

If individuals aren’t engaged with document management and legal procedures, submitting IRS forms will be incredibly daunting.

We completely understand the importance of correctly filling out documents.

Using our online application will transform professional filling of IRS 1120S - Schedule M-3 into a reality. We will handle everything for your ease and speedy completion.

- Select the button Get Form to access it and commence editing.

- Populate all required fields in your file using our enhanced PDF editor. Activate the Wizard Tool to simplify the process.

- Verify the accuracy of the information provided.

- Include the date of completing IRS 1120S - Schedule M-3. Utilize the Sign Tool to create a distinctive signature for document authentication.

- Finalize editing by clicking Done.

- Send this document directly to the IRS in the most convenient manner for you: via email, using virtual fax or postal service.

- You can print it on paper when a hard copy is needed and download or store it in your chosen cloud storage.

How to alter Get IRS 1120S - Schedule M-3 2015: personalize forms online

Opt for a trustworthy document modification solution you can rely on. Adjust, implement, and authenticate Get IRS 1120S - Schedule M-3 2015 safely online.

Frequently, altering documents, like Get IRS 1120S - Schedule M-3 2015, can be troublesome, particularly if you obtained them online or through email but lack specialized software access. Naturally, you can apply certain workarounds, but you risk producing a document that fails to satisfy submission standards. Employing a printer and scanner isn’t viable either, as it's both time and resource-intensive.

We provide a more efficient and streamlined method for altering files. An extensive collection of document templates that are simple to modify and authenticate, making fillable for others. Our platform transcends just a repository of templates. One of the finest features of utilizing our services is that you can revise Get IRS 1120S - Schedule M-3 2015 directly on our site.

As it's a cloud-based solution, it spares you from needing to download any software. Moreover, not all corporate policies permit you to install it on your work laptop. This is the ideal way to easily and securely process your forms with our service.

Bid farewell to paper and other ineffective methods of completing your Get IRS 1120S - Schedule M-3 2015 or other forms. Utilize our solution instead, which merges one of the most extensive libraries of editable forms with robust document editing services. It's simple and secure, and can save you significant time! Don't just rely on our word, experience it for yourself!

- Click the Get Form > and you’ll be promptly directed to our editor.

- Once opened, you can commence the customization procedure.

- Select checkmark or circle, line, arrow, and cross among other choices to annotate your form.

- Choose the date option to insert a specific date into your template.

- Incorporate text boxes, images, and notes to enhance the content.

- Employ the fillable fields option on the right to insert fillable fields.

- Select Sign from the upper toolbar to create and add your legally-binding signature.

- Hit DONE and save, print, and distribute or download the result.

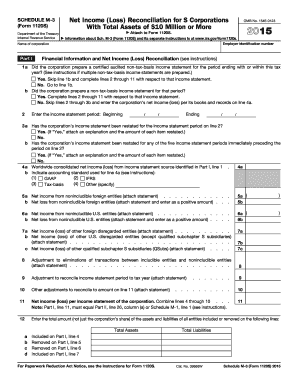

3 on a tax return is a part of IRS Form 1120S that requires corporations to disclose their financial statements in a detailed format. This schedule aims to enhance transparency between book and taxable income. Businesses must prepare it carefully to ensure accurate tax compliance. If you need guidance, US Legal Forms offers tools to streamline this process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.