Get Irs 12277 2011-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 12277 online

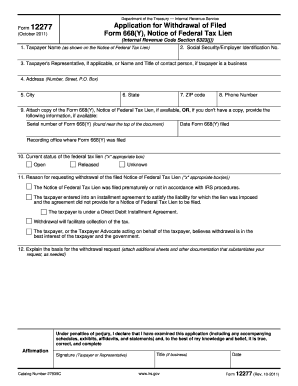

The IRS Form 12277 is used for applying to withdraw a previously filed Notice of Federal Tax Lien. Completing this form accurately is essential for facilitating the removal of the lien, which can positively impact your financial status. This guide provides detailed instructions for filling out the form online.

Follow the steps to complete the IRS 12277 application online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in Section 1 with the taxpayer's name as it appears on the Notice of Federal Tax Lien. Ensure the spelling is accurate for processing.

- In Section 2, provide the Social Security Number or Employer Identification Number corresponding to the name you've entered.

- If applicable, complete Section 3 with the name and title of the taxpayer's representative or contact person. If the taxpayer is an individual, leave this section blank.

- Enter the current address of the taxpayer or representative in Sections 4-8, ensuring all details such as number, street, city, state, and ZIP code are accurate.

- In Section 9, attach a copy of the Form 668(Y), Notice of Federal Tax Lien, if available. If not, provide the serial number, filing date, and recording office information to aid the process.

- Check the appropriate box in Section 10 to indicate the current status of the federal tax lien: 'Open,' 'Released,' or 'Unknown.'

- In Section 11, select one or more reasons for requesting the withdrawal of the lien by checking the corresponding boxes.

- Use Section 12 to explain the basis for your withdrawal request in detail. Attach additional sheets if necessary to provide all supporting documentation.

- Affirm your application by signing and dating the form. If you are completing the application for a business, include your title.

- Finally, save your changes, and proceed to download, print, or share the completed form as required.

Complete your IRS 12277 application online today for a smoother withdrawal process.

Related links form

The IRS Fresh Start Program is designed for taxpayers who owe back taxes and want relief from liens or garnishments. To qualify, you generally must meet specific income criteria, arrange payment plans, or resolve your tax debts fully. If you are looking to leverage this program, consider using Form 12277 to withdraw any current liens as part of the Fresh Start approach. Resources like US Legal Forms can help you navigate the eligibility requirements efficiently.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.